From its launch back in 2009 to now, at the outset of 2021, Bitcoin stands as the most popular cryptocurrency among the global crypto community. More often than not Bitcoin is compared to gold as a great alternative investment option; in fact, in recent times, a number of investors have been leaning more towards Bitcoin as their preferred investment option.

Gold and Bitcoin share quite a few similar features. To start with, both assets are utilized as stores of value, both have a limited supply, and both are obtained through a process known as mining — even though it varies wildly for the two. While gold is mined directly from the earth, Bitcoin mining — BTC being a virtual asset — is done through computational means. Plus, Bitcoin miners receive a reward after successfully mining a coin.

Since the supply of Bitcoin is limited, the crypto community has long since been poring over what happens once the last Bitcoin is mined. With this post, we aim to give you a clear understanding of the future of Bitcoin.

But first, let’s get into the basics of Bitcoin mining, shall we?

How Exactly Is Bitcoin Mining Done?

Bitcoin mining is done by a group of users on the BTC network known as miners. They have to solve complex mathematical riddles to add the trades made on the Bitcoin blockchain to the ledger as virtual blocks, and in return, they receive newly generated BTC as reward. Bitcoin mining is done with high-powered devices and software designed specifically to aid in mining. As of right now, new bitcoins are minted at the fixed rate of one block every ten minutes.

As set forth in Bitcoin’s source code by its creator — the infamous Satoshi Nakamoto — there will only ever be 21 million BTC in circulation.

Why does Bitcoin have a limited supply, you wonder?

Well, many crypto community members across the globe think it’s because the creator(s) intended the price of BTC to eventually line up with those of conventional fiat currencies. Plus, the fixed supply also shields Bitcoin against inflation.

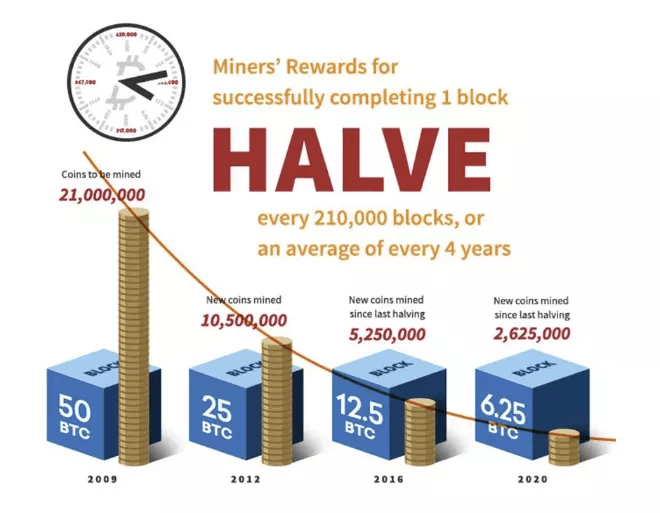

In more than a decade since Bitcoin’s initial launch, around 18.5 million BTC has already been mined, which leaves less than three million BTC that’s yet to be generated. This steadily diminishing supply of bitcoins also affects the rewards Bitcoin miners receive, as the amount of Bitcoin generated with each newly created block is reduced by 50% about every four years.

Bitcoin Mining Rewards

When Bitcoin was first launched, the reward for creating one legitimate block was 50 BTC. In 2012, it got halved to 25 bitcoins, and again in 2016, the reward per block was reduced to 12.5 bitcoins. On May 11, 2020, the reward halved to 6.25 BTC.

(Source: Investopedia)

Presuming the rewarding process keeps adapting in a similar fashion, the reward will continue to halve every four years until the last BTC is mined. Therefore, the last BTC would most likely be mined around the year 2140. However, there’s always the possibility that the Bitcoin network protocol and BTC’s mining power would be altered between now and then.

So, What Happens After the Last Bitcoin is Mined?

While some crypto enthusiasts opine that once the initial supply of BTC is wholly in circulation, the people behind the Bitcoin network would just alter the protocol to allow additional supply to be generated. However, if the supply of BTC is indeed capped at 21 million a little over a hundred years from now on, how would the miners, traders, and the broader cryptocurrency market be affected?

Below, we round up some plausible repercussions.

How Would the Miners be Affected?

Many members within the crypto community seem to believe that miners won’t have a way to earn off of the Bitcoin protocol once the last BTC is out in circulation. However, there are actually two types of rewards to be had from Bitcoin mining: a fixed amount of BTC for every confirmed block, and incentives from the transaction fees that miners receive for each transaction they process and verify. The higher the transaction fees, naturally the higher the incentives.

The transaction fees are the equivalent of a few hundred dollars per block currently, but they could potentially increase to thousands of dollars per block with time, right alongside BTC’s value and the number of transactions on the Bitcoin blockchain. But even when the last Bitcoin has been mined, it would need to be profitable for the miners to continue processing new transactions and creating new blocks.

How will this play out? If transaction fees goes up to hundreds (or thousands) of dollars, Bitcoin adoption may be severely impacted. Perhaps we’ll move to a different way of mining transactions, such as Proof-of-Stake in Ethereum 2.0

.

What Advances Would the Mining Tech Make?

With the mining technology used by Bitcoin miners right now, the complete reliance on transaction fees would surely make mining difficult to afford, which would, in turn, lead to a decrease in the number of miners, since small scale miners wouldn’t be capable of affording the Bitcoin mining technology anymore. The expensive mining equipment can also lead to the centralization — and eventual collapse — of the Bitcoin network.

However, judging by the rapid evolution of technology witnessed over the past century, the coming century is bound to see significant progress in mining tech. The cost of mining would hopefully be lowered, increasing profitability; plus, mining hardware would have to be energy efficient as well.

Notably, specialized mining hardware — like ASICs (application-specific integrated circuit) — have already been invented that help simplify the Bitcoin mining process, and make it easier to afford.

How Would the Market Price of Bitcoin be Impacted?

With the Bitcoin supply being emptied, the miners would see a dip in rewards, and they certainly wouldn’t want to sell the BTC they own for a low price. Therefore, once the last BTC is mined, there will most likely be an increase in BTC’s price.

With more than a hundred years to go until the last BTC is mined, the Bitcoin network could change a lot, and what those changes would be is anybody’s guess. However, it’s quite safe to assume that Bitcoin holds the potential to revolutionize the financial system worldwide in the coming years.

Thinking of entering the cryptocurrency market by investing in Bitcoin, or any other cryptocurrency? Giottus has already made its place within the Indian crypto markets as one of the most reliable and relatively inexpensive platforms for traders to buy, sell, and trade over forty popular cryptocurrencies, including Bitcoin, Ripple, Ethereum, Bitcoin Cash, Tron, Tether, and more.

To find out more about how you can go about making your first trade, do give our website a visit!