Let us decode the metrics that point to a sustained bullishness ahead for crypto in general and Bitcoin in particular.

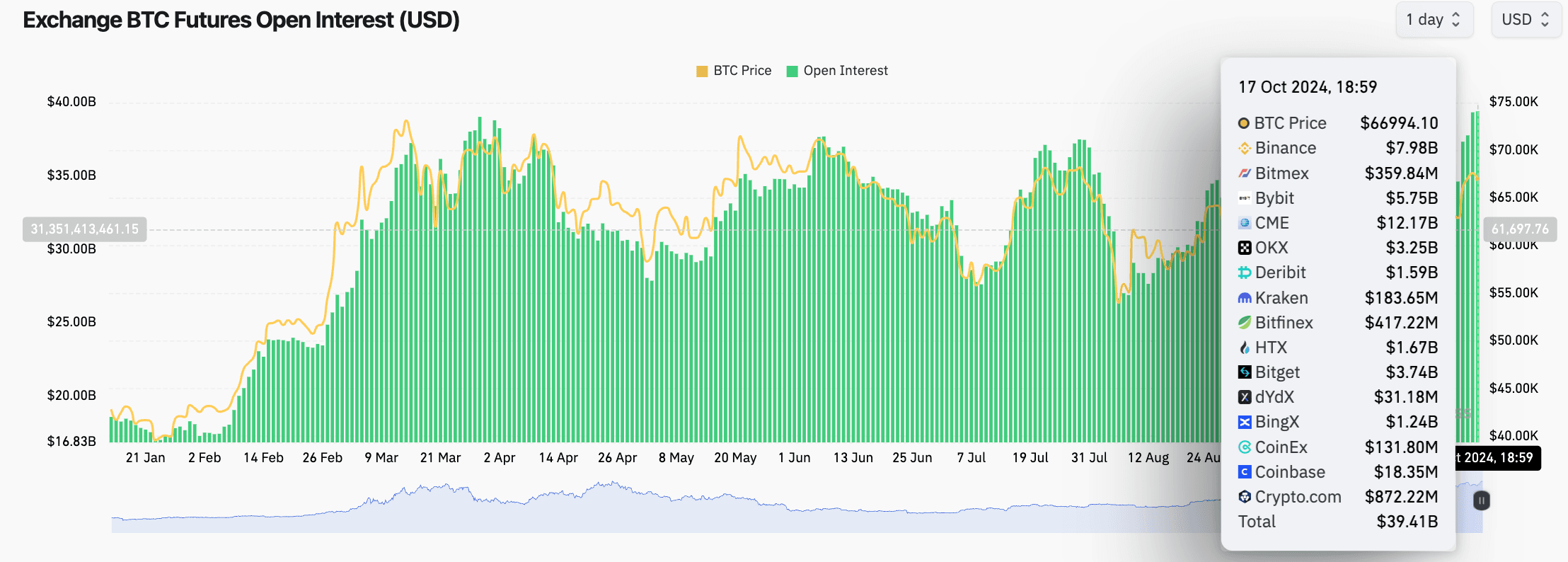

Bitcoin open interest reaches new high

Bitcoin’s open interest has surged to a record high of $39.4 billion, while funding rates have hit their highest level since August. This suggests that the majority of open interest is leaning towards long positions, signalling a strong bullish sentiment in the market.

The upward trend in the futures market reflects a growing wave of liquidity and heightened attention within the crypto space, with traders showing increasing confidence in Bitcoin's potential.

Source: Coinglass

Bitcoin dominance breaks cycle ceiling

Bitcoin's market dominance has climbed to 58.9%, its highest level since 2021. This measure, which reflects Bitcoin's share of the total crypto market, has been steadily rising since hitting a low of around 38% following the 2022 bear market. Today’s dominance level is similar to what we saw at the start of the 2020-21 bull run, hinting at a possible shift in market dynamics.

Bitcoin Dominance; Source: Tradingview

The steady increase suggests Bitcoin has been outperforming altcoins in recent months. Historically, a rise in Bitcoin dominance has often been linked to market consolidation or the early stages of bullish trends, as capital gravitates back to the most trusted asset in the space.

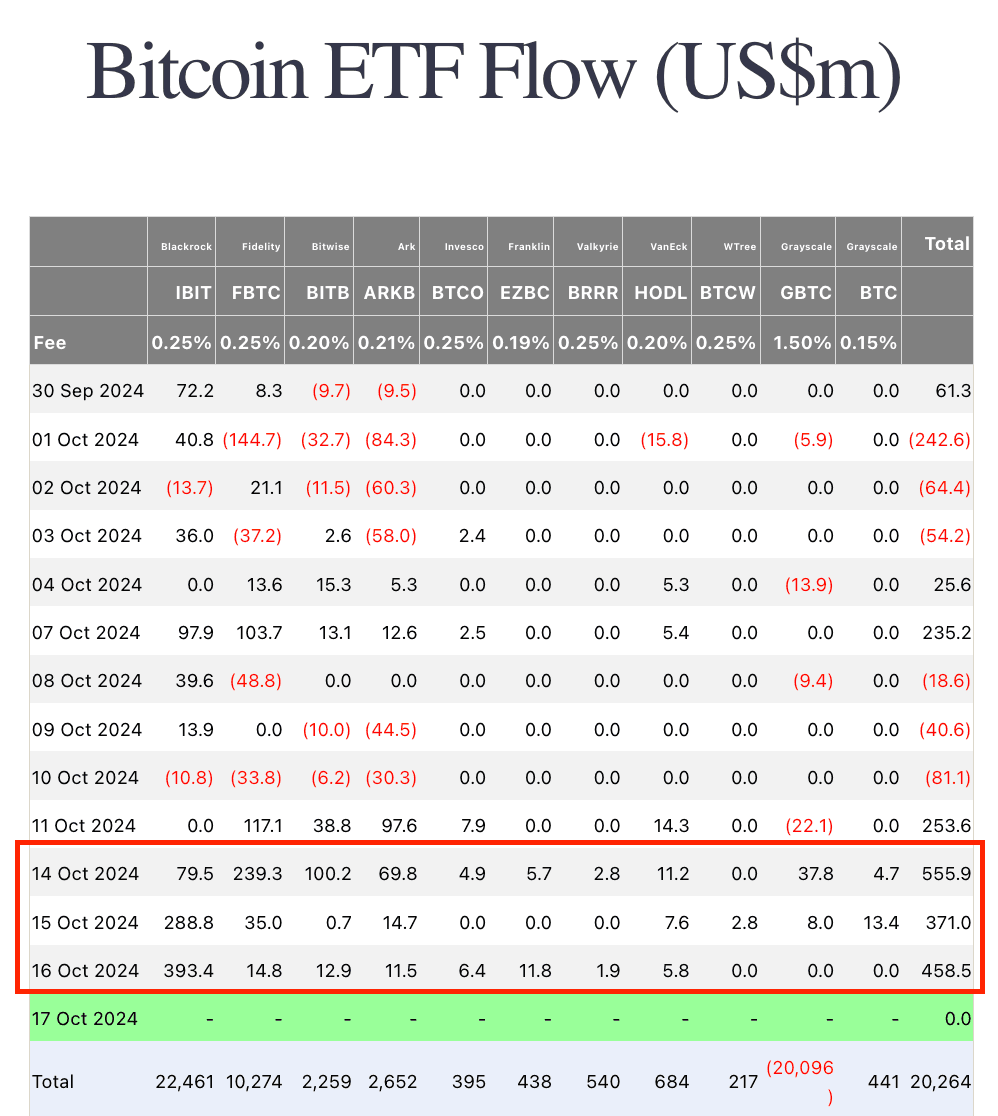

Bitcoin ETFs records over $1.4 billion inflows this week

Bitcoin ETF saw $1.4 billion in net inflows across the past three trading days. Blackrock alone received $762 million worth of Bitcoin, according to Farside data.

Source: Farside

The strong inflows into Bitcoin ETFs particularly in Fidelity, BlackRock, and Ark funds, suggest increasing confidence from institutional investors. Ethereum ETFs, while quieter, also saw renewed interest with BlackRock leading the way.

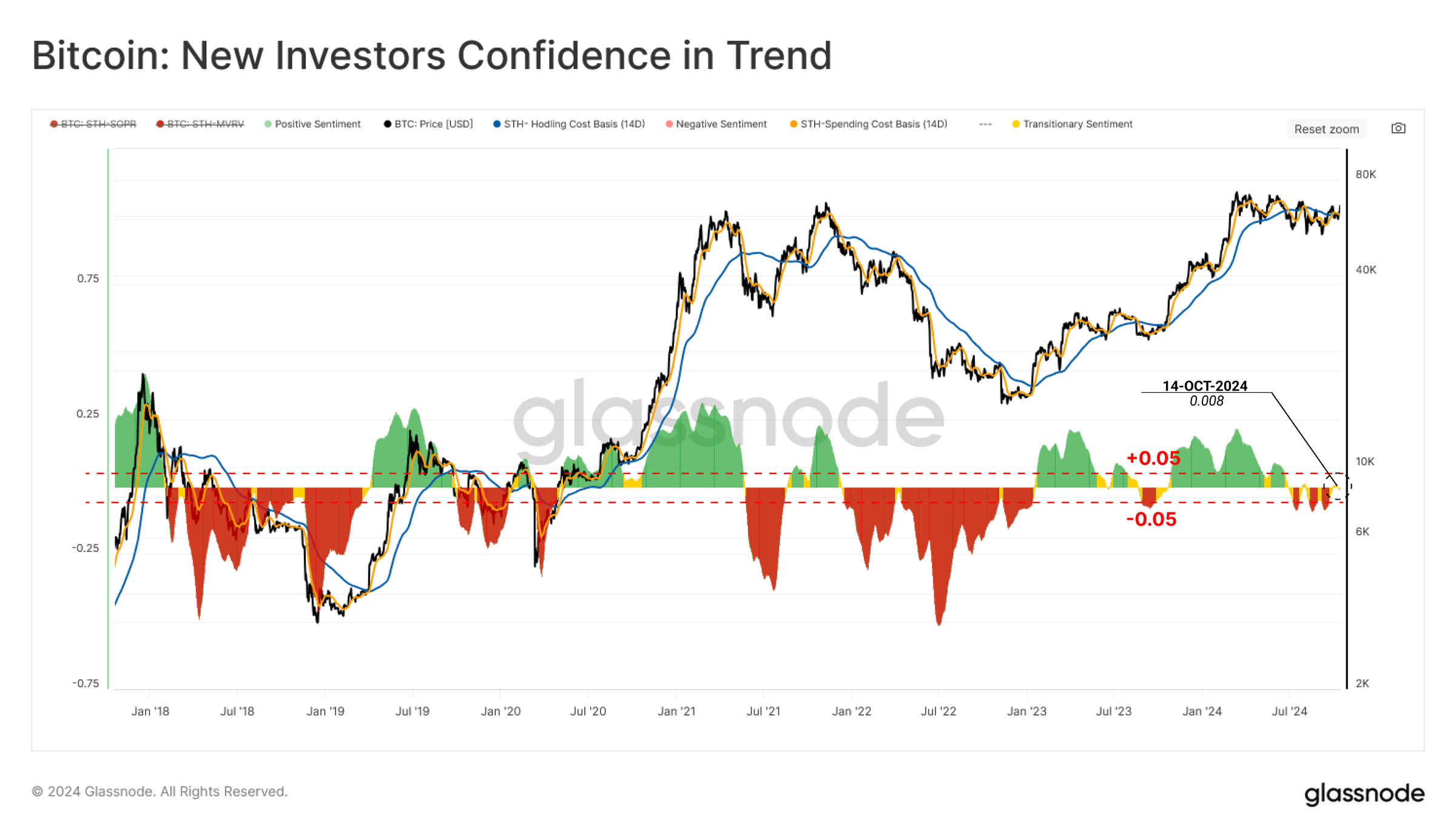

New Bitcoin investors show strong optimism

Despite the recent market turbulence and mildly negative sentiment, confidence among new Bitcoin investors remains notably higher than in the 2019-20 and 2021 markets. One key factor driving this resilience is the lack of unrealized losses among newer investors, highlighting that investor profitability has not suffered significantly.

Source: Glassnode

This stability suggests that financial pressure on Bitcoin holders is relatively low, with minimal fear driving sell-offs. As a result, the likelihood of Bitcoin plunging into a deep bear market seems limited for the time being. This points to a more robust and confident investor base, even amid challenging conditions.

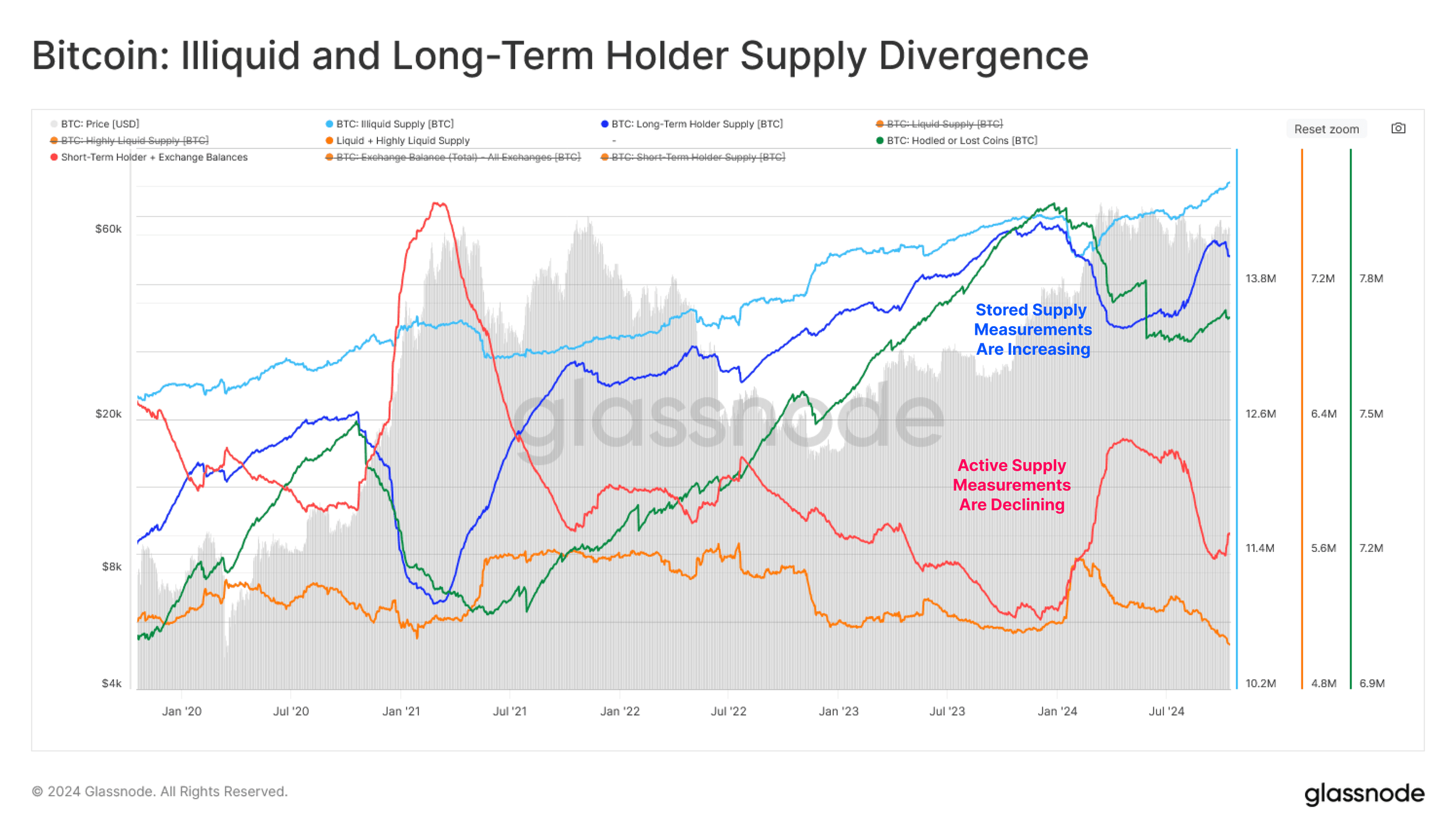

Tendency to HODL is rising

The chart below shows different types of Bitcoin supply: one being the "available supply," which includes coins held by short-term holders or those that are easily sold. The other is the "stored supply," which includes coins held by long-term holders or stored away in vaults.

Source: Glassnode

What we're seeing is a steady increase in the "stored supply," meaning more people are choosing to hold onto their Bitcoin rather than sell it. As a result, the "active supply" has decreased, meaning fewer Bitcoins are being traded or used at the current price levels. This suggests that many investors are holding on, likely waiting for higher prices.

Zooming out, what do these metrics mean?

We are entering a pivotal moment for Bitcoin. With the asset beginning to factor in the effects of this year’s halving, global interest rates being cut, and growing bullish sentiment among investors, the stage is set for significant movement.

Additionally, the possibility of Trump reclaiming presidency in the US could introduce policies aimed at boosting asset prices, creating an even more favourable environment for Bitcoin.

The next few weeks may prove critical for the entire crypto ecosystem, potentially sparking a bull rally that could drive Bitcoin to new all-time highs, with the $70,000 mark now within sight.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.