After the financial crisis of 2008, the pseudonymous Satoshi Nakamoto brought Bitcoin into the financial markets; among their many reasons for doing so, there was also the factor that Bitcoin was born as an instrument to combat inflation. Even if you’ve been in the know regarding the crypto markets for a while now, you might not be aware of what role a cryptocurrency can play during inflation. In this post, we discuss the role virtual currencies play during inflation, and further, how you can utilize stablecoins as a hedge against inflation.

What is Inflation?

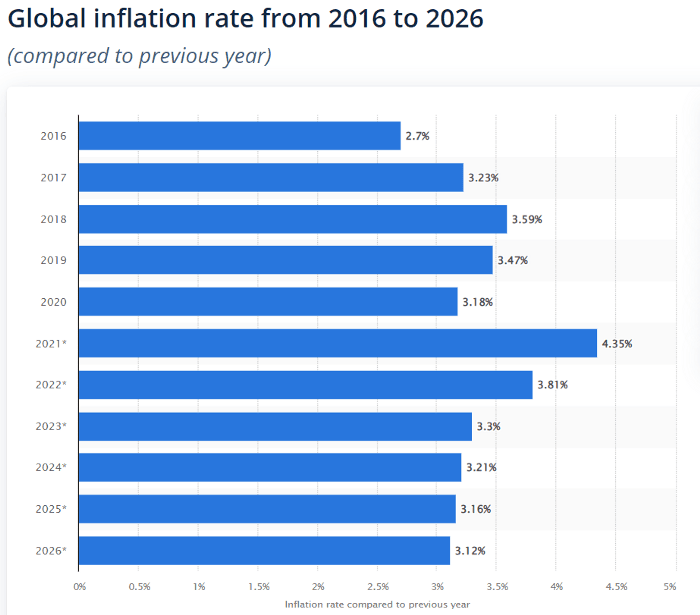

Inflation is the term used to describe the continuous increase in the prices of various goods and services across the global markets. Since the aforementioned global financial crisis of 2008, the global economy has suffered many times, resulting in a rise in overall global inflation. After the Covid pandemic in 2020, the worldwide inflation rate turned out to be about 3.18% compared to the previous year, as can be seen in the chart above.

More recently in India, the annual inflation rate rose up to a seven-month high of 6.01% in the January of 2022, from an upwardly revised 5.66% noted back in December 2021.

While at a glance the rising numbers may seem fearsome, according to the famous economist John Maynard Keynes, in some particular situations inflation can actually prove to be a good thing for the economy, creating new job opportunities at downtimes and boosting finances. A low inflation rate, specifically, works to trigger investments, spendings and borrowings- all of them amplifying healthy growth for the economy.

However, it is also true that once inflation goes out of control at uncertain times, hyperinflation is bound to follow, resulting in overall economic decline as the values of goods and services go up and wages barely budge for the average worker, currency purchase power takes a hit, and living expenses become exorbitant.

Therefore, to put it simply in one sentence: higher inflation rates chip away at the value of your savings while lower inflation rates slow an economy. According to Statista, the global regions to deal with higher year-on-year inflation rates usually are the Middle East and North Africa, as well as the Africa Sub-Sahara. People who live at places like this with hyperinflationary economies require to prioritize spending, or money they save up might continue to lose value.

What Role Does Crypto Play During Inflation?

Global inflation has long since affected the value people store in fiat currency, therefore investors have been trying to protect themselves from hyperinflation by investing in other assets that have been known to better stick to their actual values. The precious metal gold is an asset class that is frequently held as a protection against inflation by traditional investors. However, since the emergence of the crypto Bitcoin, crypto assets have become popular as an alternative investment that investors are using as a hedge against inflation.

Is Bitcoin an Effective Hedge Against Inflation?

As Satoshi Nakamoto designed the crypto Bitcoin, it is a deflationary asset, and people in countries that have unstable fiat currencies are using it as a store of value that can provide protection against inflation already. Now, why might Bitcoin- or any other crypto for that matter- serve as a good hedge against rising costs of essential goods and services? There are several reasons to it, such as-

- While fiat currency can be manipulated with increased money printing or shifting interest rates, cryptocurrency does not follow the same rule.

- Bitcoin or any other crypto- just like gold- is not tied to the value of a particular currency like the US dollar. Plus, Bitcoin is decentralized and not controlled by a group of companies or stakeholders. Instead, Bitcoin is an international asset class that reflects demand across the globe. Therefore, Bitcoin altogether avoids many of the political and/or economic risks associated with fiat financial markets around the world.

- Bitcoin has a limited supply of 21 million coins, and as of the beginning of 2022, about 19 million of these bitcoins have already been minted. This proves Bitcoin a better inflation hedge than even most other cryptocurrencies, as this way new coins are released into circulation methodically and there will only ever be a certain number of coins, eliminating the risk of inflation.

- Bitcoin possesses all the qualities that make gold a good hedge against inflation- it’s secure, easily interchangeable, durable, and scarce. However, in addition to all that, Bitcoin is also portable, more decentralized, and transferable. Since the supply of gold is to some extent controlled by powerful countries like the U.S., China, and European countries like Germany, in theory, Bitcoin can also be protected more easily than a precious metal like gold that has physical existence.

- In countries prone to hyperinflation and political crises, a digital currency like Bitcoin brings forth a much better means of exchange than fiat money.

Stablecoins Can Also Prove to be a Good Inflation Hedge

While cryptocurrencies can serve as a good hedge against inflation, many new investors are hesitant about holding crypto, as the crypto markets are exceedingly volatile. However, in that case, you can consider using stablecoins like USDT for protection against hyperinflation. While they share most features of regular cryptocurrency, stablecoins are usually backed by fiat currency at a 1:1 ratio, like USDT is backed by the US dollar. This makes stablecoins less prone to volatility than regular crypto coins like Bitcoin.

It’s up to you as the investor to choose whether you want to invest in Bitcoin or any other crypto, or even a stablecoin, to protect yourself during any future financial crisis. You can get started as a crypto investor on Giottus, a platform that has established itself as one of the leading crypto exchanges in India. We wish you good luck on your journey as a crypto investor!