Despite billions in liquidations last week, HYPE, the native token of Hyperliquid has managed to hold well. Let us look at Hyperliquid's key numbers to give you the real story on where it stands and where it might be headed.

What is Hyperliquid?

Hyperliquid is a high-performance Layer 1 blockchain designed for decentralized trading at centralized exchange speeds. Launched in November 2024, it quickly gained recognition for its blazing-fast transaction speeds of 200,000 transactions per second (TPS) and 0.2-second block time - currently the fastest in crypto world.

Unlike traditional decentralized exchanges (DEXs), Hyperliquid provides a seamless, low-latency experience similar to centralized exchanges like Coinbase or Giottus. However, its impressive speed comes with trade-offs: the network relies on 16 validators, raising concerns about security, centralization, and potential single points of failure.

Despite these risks, the HYPE token has exploded in popularity thanks to strong tokenomics, a successful airdrop to 94,000 wallets, and its dominance in decentralized perpetuals trading.

Watch how to trade HYPE on Giottus here.

Key Metrics at a Glance

Here’s why traders and investors are paying attention:

• $1.46B TVL – More than Aptos, Polygon, and Cardano

• $2.5B in Stablecoins – Surpassing Avalanche, Near, and Fantom

• $62.5B 7-Day Perps Volume – The highest of any Layer 1 blockchain

• $57.4M in 30-Day Fees – Ranked 15th among all crypto apps and blockchains

• 150,300 HYPE ($3.8M) Burned – Making the token deflationary

• 43% of HYPE Staked – Higher than ETH and BNB staking percentages

Hyperliquid DEX stands out as one of a kind

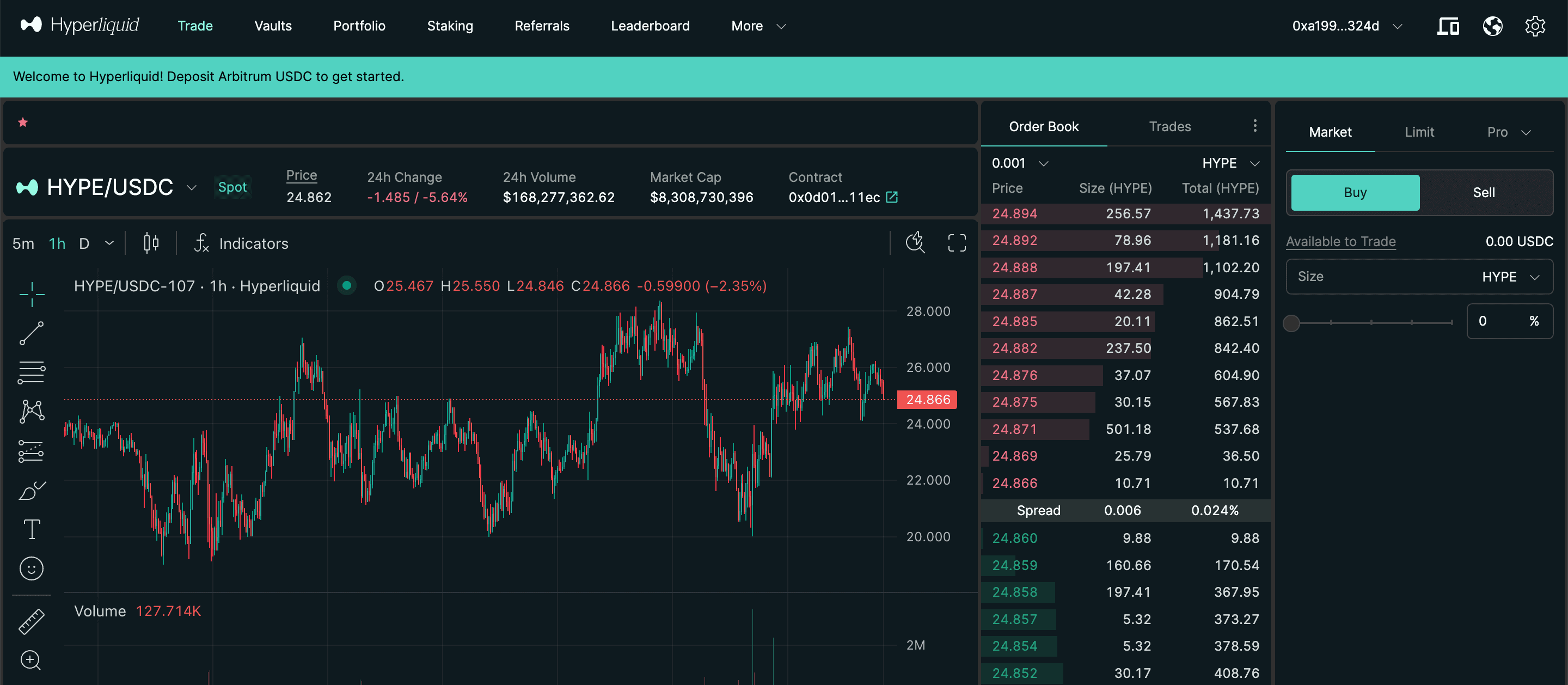

Hyperliquid DEX is reshaping how decentralized trading should happen with its lightning-fast trade execution and gas-free experience on the Hyperliquid network. Offering a trading experience nearly identical to centralized exchanges, it supports over 100 token pairs and provides access to leveraged trading.

Hyperliquid trade view. Source: HyperLiquid

To kick off user adoption, Hyperliquid launched with free trading for the first three months. Later, a 0.25% taker fee and a 0.2% maker rebate were introduced. Rebates are now exclusive to market makers who meet specific volume thresholds.

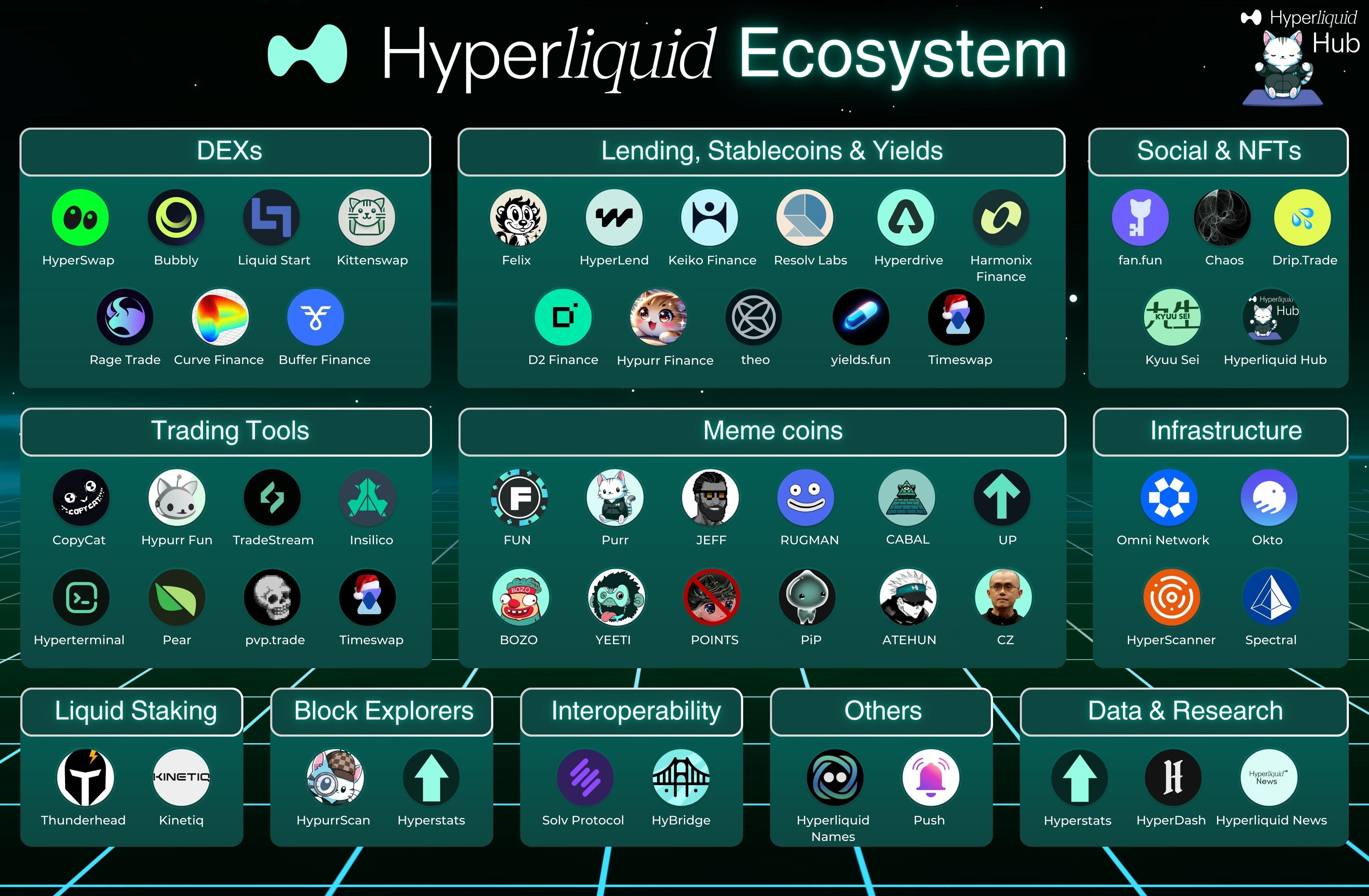

Early ecosystem reflects promising foundation

While the Hyperliquid ecosystem is still in its infancy, the upcoming HyperEVM promises to expand its potential by allowing seamless deployment of Ethereum-based apps.

Existing protocols like Hypurr Fun (trading), Hyperswap (DEX), and Hyperdrive (lending) are already gaining traction, alongside NFT marketplaces like Drip.trade and memecoins like PURR, which currently holds an $79 million market cap. With more projects expected to launch following the HyperEVM rollout, Hyperliquid is primed to attract even more users and developers, further solidifying its position in DeFi.

Hyperliquid ecosystem. Source: X

What helped the token stay strong during the market slump?

1. Steady Whale Buying Activity: Influencer Adin Ross and his 50,000 followers boosted the Hyperliquid (HYPE) token's popularity. Big investors, including one who spent close to a million dollars, also bought in.

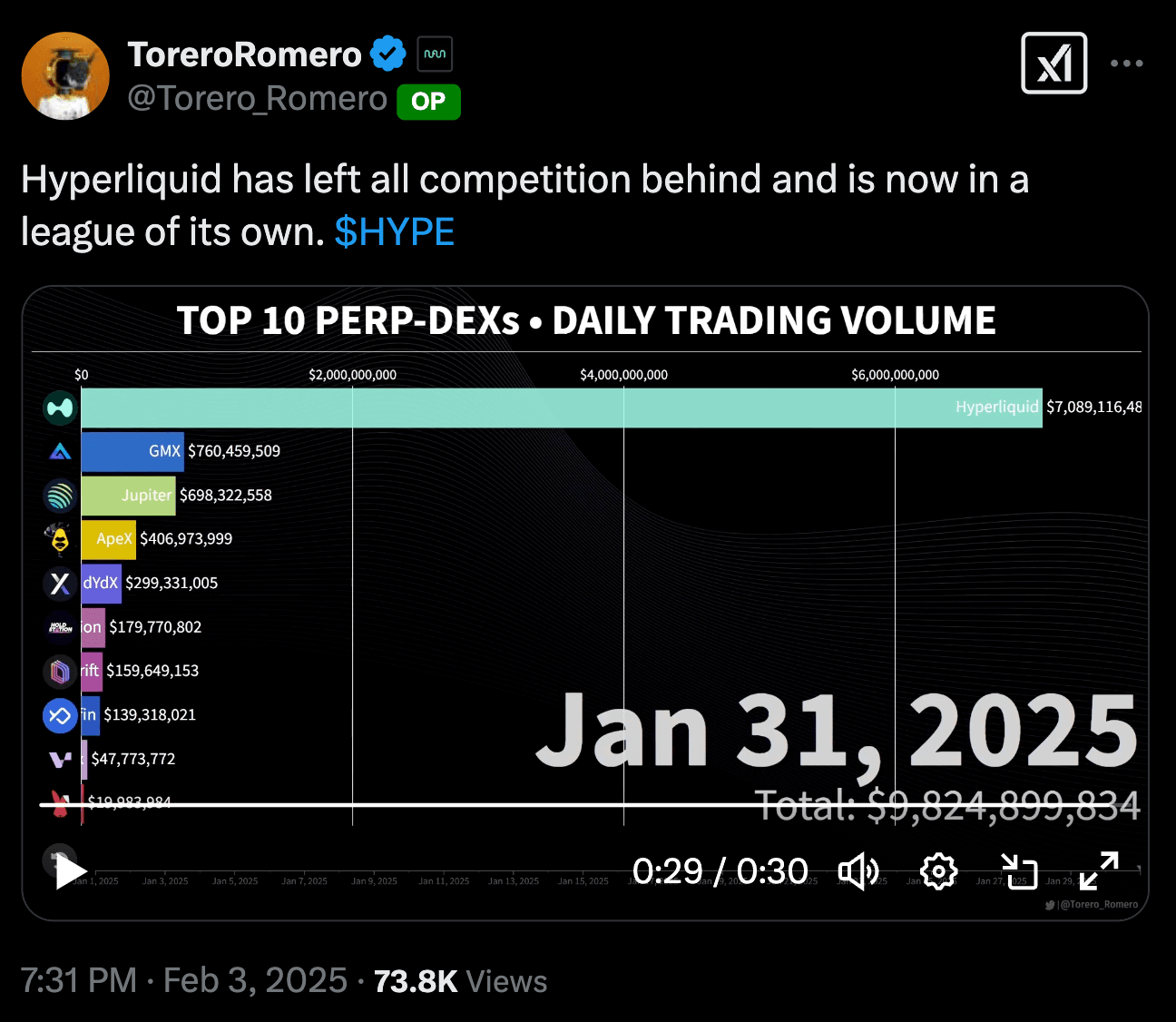

2. Massive Trading Volume: Hyperliquid boasts billions in daily trading volume, reaching $7 billion on January 31, 2025. This high volume helps keep the HYPE token's price stable. Its popularity stems from easy access (no KYC required) and low trading fees. Even with low fees, the large user base generates $9 million in weekly revenue. This has helped the platform to maintain stability during volatile times.

Hyperliquid trade volume. Source: X

HYPE technical analysis

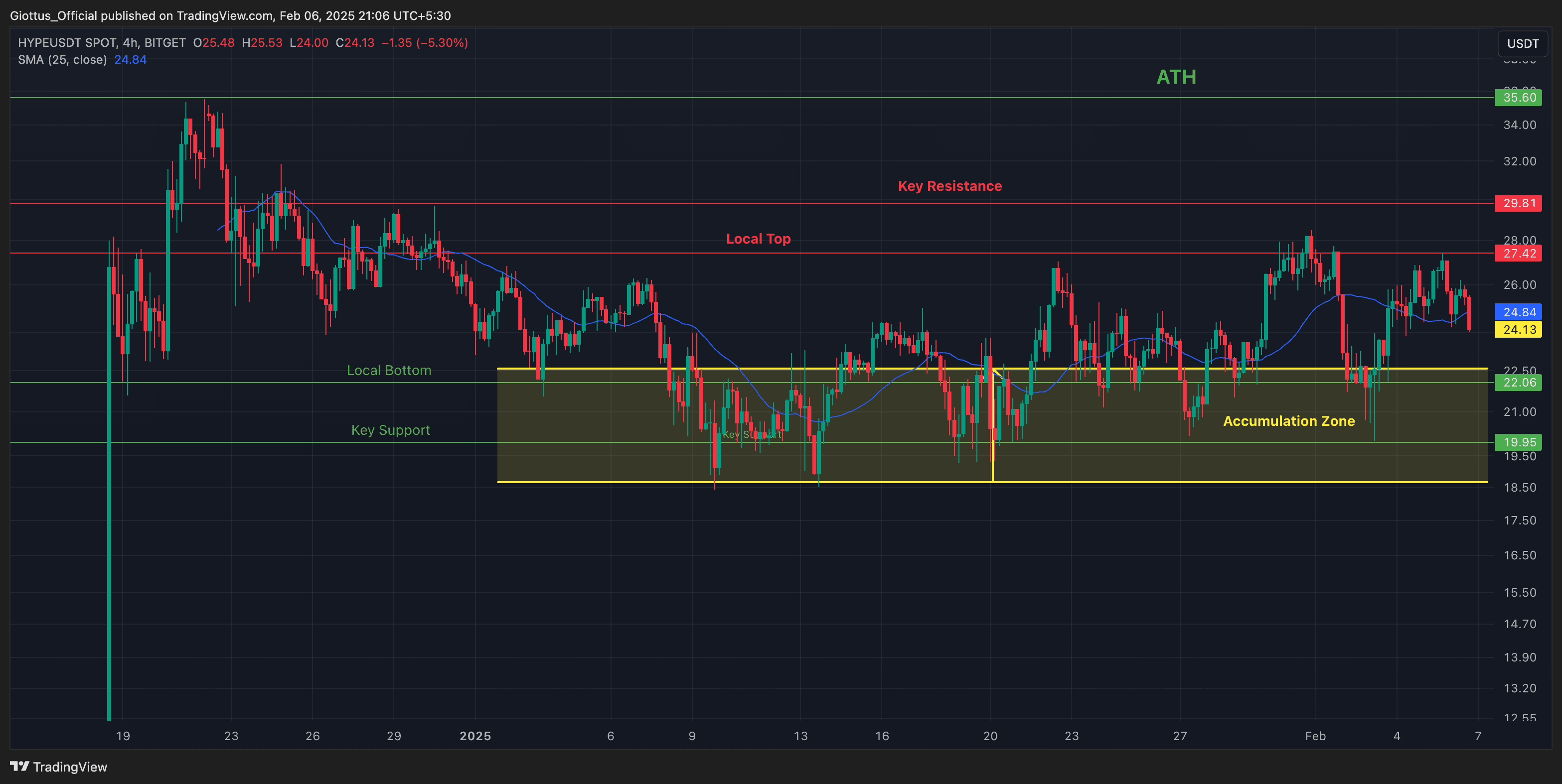

HYPE's price action on the 4-hour chart reveals a December peak of $35.6 before a pullback to $25.35. Since January 29, we've observed the formation of an inverse head and shoulders pattern, characterized by a series of higher highs and higher lows – a potentially bullish signal.

Currently, HYPE appears to be consolidating. A positive shift in the broader market sentiment could propel the price towards the key resistance level at $29.8. A decisive break above this resistance would open the door for further upside, with the all-time high of $35.6 as the next significant target.

Conversely, a break below the crucial support level at $20 would suggest further downside risk, potentially targeting $18.5. It's worth noting that the zone between $18.5 and $22.5 could represent a valuable accumulation area for long-term positions, anticipating future upside potential.

HYPE technical analysis. Source: Giottus on Trading View

Key Takeaway

Hyperliquid takes a different path than many crypto projects, prioritizing user engagement and sustainable growth over hype. Its user-centric, low-fee approach fosters a strong community, setting it apart from token-driven ventures. While other on-chain derivatives platforms exist, none replicate Hyperliquid's unique blend of integrated order books, a dedicated Layer-1 blockchain, and user-focused economics.

Hyperliquid's strong product development, including features like HIP-1 and democratized market making, combined with its go-to-market strategy, has fueled significant adoption. Its lack of external investors further strengthens its community focus and long-term vision. These factors position Hyperliquid as a key player in the DeFi space.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.