Ethereum is experiencing a renewed surge in network activity and price momentum. In the past two days alone, ETH's price has jumped around 10%, pushing past $2,900 and potentially eyeing the $3,000 mark in the near term. This rise is matched by a significant uptick in on-chain activity, with network fees climbing nearly 60% as user engagement surges.

This is in contrast to recent months when Ethereum’s network activity saw a decline; in August, the seven-day moving average of daily transaction volume had dropped approximately 55%, from $6.6 billion in July to $2.9 billion. In today’s issue, we explore the factors fuelling this bullish momentum for Ethereum and examine the potential catalysts poised to drive ETH even higher.

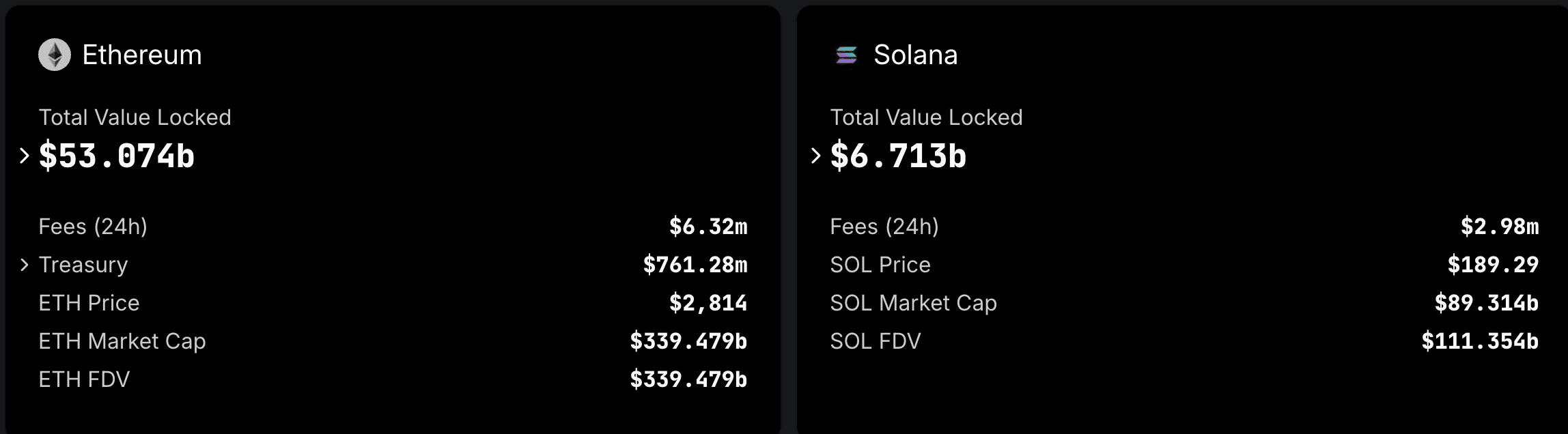

Dominant network effect - Over $50 billion locked

Ethereum leads the decentralized finance (DeFi) space by a massive margin, with over $50 billion locked in its smart contracts, according to DeFi Llama. This is more than any other blockchain, including competitors like Solana, which has around $6 billion locked in DeFi.

Source: DefiLlama

Ethereum’s position as the backbone of DeFi strengthens its demand, as anyone wanting to interact with DeFi must use ETH for transaction fees. The network effect is clear: more DeFi activity means more demand for ETH, adding both utility and value.

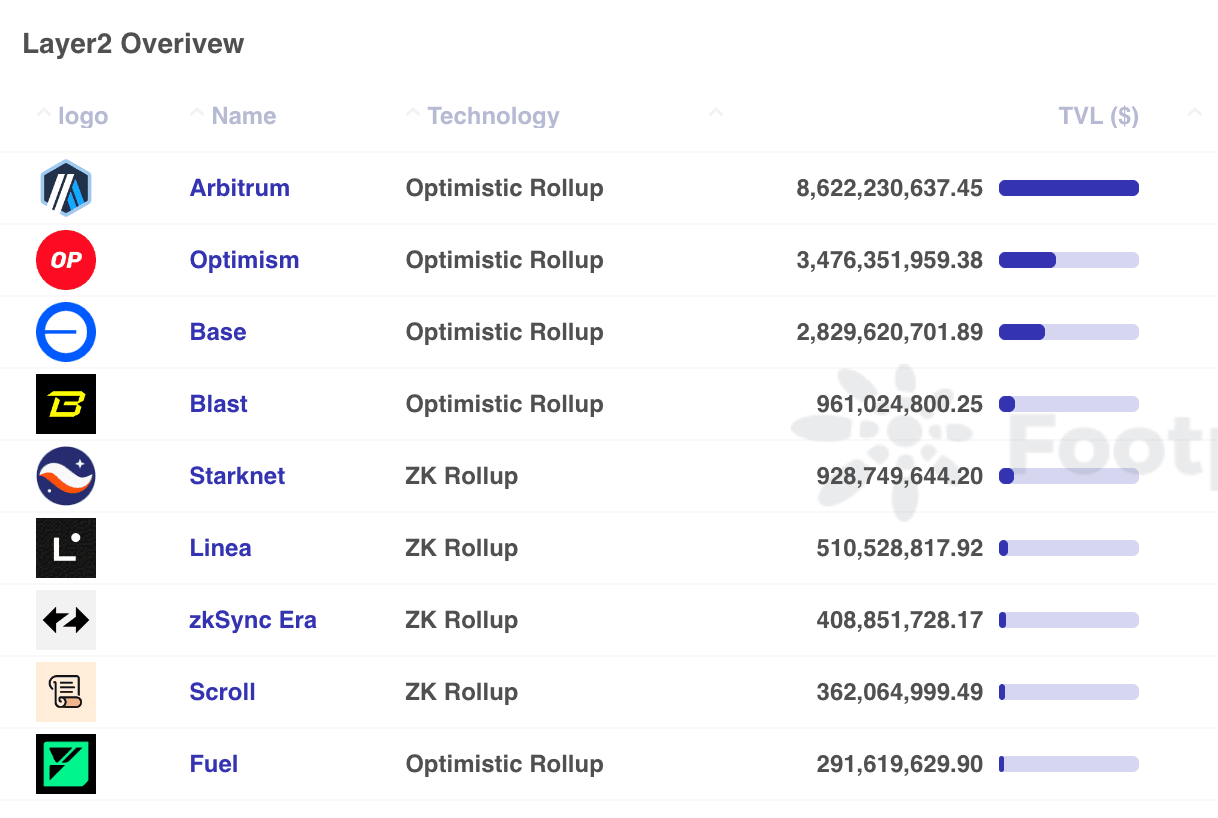

Explosive Layer 2 adoption: Over $10 billion in TVL

Layer 2 (L2) solutions, which help scale Ethereum by processing transactions off the main chain, have seen rapid growth. L2 platforms like Arbitrum and Optimism now hold over $11 billion in total value locked (TVL) collectively, according to data from Footprint Analytics.

Source: Footprint Analytics

By handling a growing portion of Ethereum’s transactions, L2s are crucial for Ethereum’s scalability. With L2s expected to continue rising in popularity, the Ethereum ecosystem can support more users and applications, which translates to sustained demand for ETH.

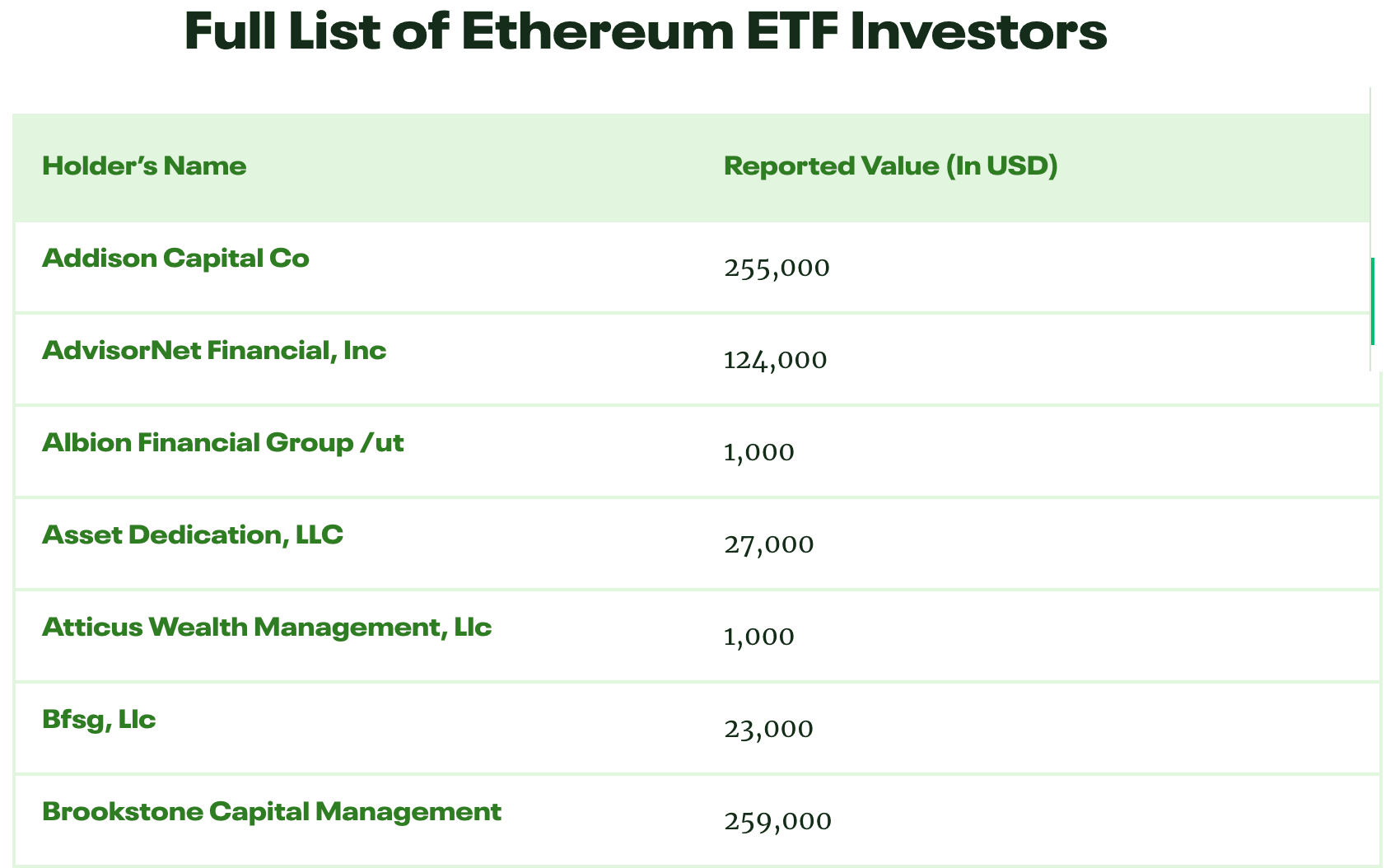

Institutional buying: ETF demand continues to grow

Institutions are typically long-term holders, and as demand for Ethereum investment products grows, so does ETH’s potential for value appreciation. This influx of capital indicates that big players are betting on Ethereum’s future as a top asset, much like they have with Bitcoin.

We are witnessing institutional interest picking up. A recent article in CCN, reveals substantial crypto holdings across various investment firms, including hedge funds, family offices, and other financial institutions.

Source: CCN. A complete list of holders can be found here.

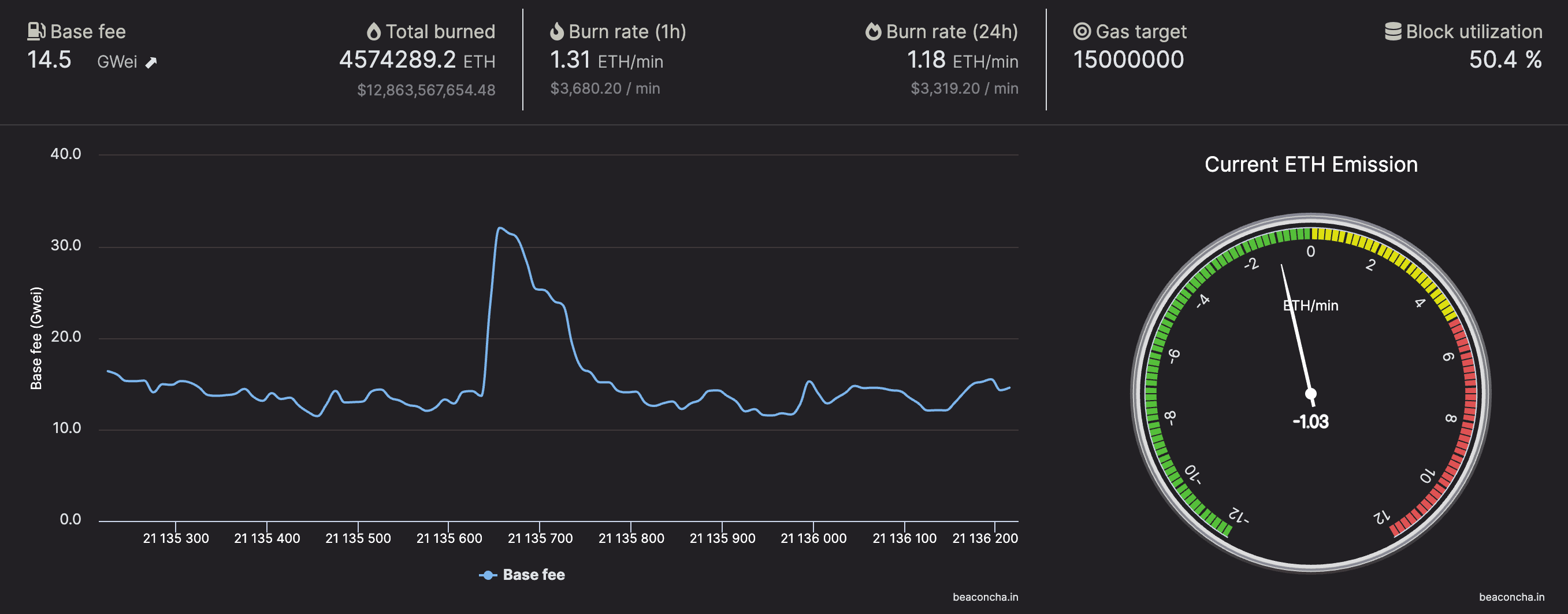

Deflationary Pressure: 4.5 million ETH burned since EIP-1559

Ethereum’s shift to a deflationary asset has been significant. Since the EIP-1559 update in 2021, over 4.5 million ETH (worth around $12 billion) has been burned, effectively reducing supply. Coupled with the switch to Proof-of-Stake (PoS), which reduces new ETH issuance by about 90%, ETH has been consistently deflationary during high network activity.

Source: Beaconcha

With more ETH being burned, supply shrinks as demand holds or rises, boosting ETH’s scarcity. This deflationary trend is a strong indicator for long-term price growth, especially as Ethereum’s network usage continues to grow.

ETH has found a bottom against BTC?

Biggest critic of ETH have been pointing out that ETH has been decimated against BTC in the last year or so. However, we have to accept the reality that a bottom for this pair may already be in for this cycle. Typically, Bitcoin moves first, followed by Ethereum and then other altcoins. Is that what we are seeing now?

How has ETH fared post-US elections?

Technicals display strength

Ethereum's rise sparked $57 million in liquidations yesterday, with long and short liquidated positions accounting for $19.8 million and $37.4 million, respectively.

Source: Coinglass

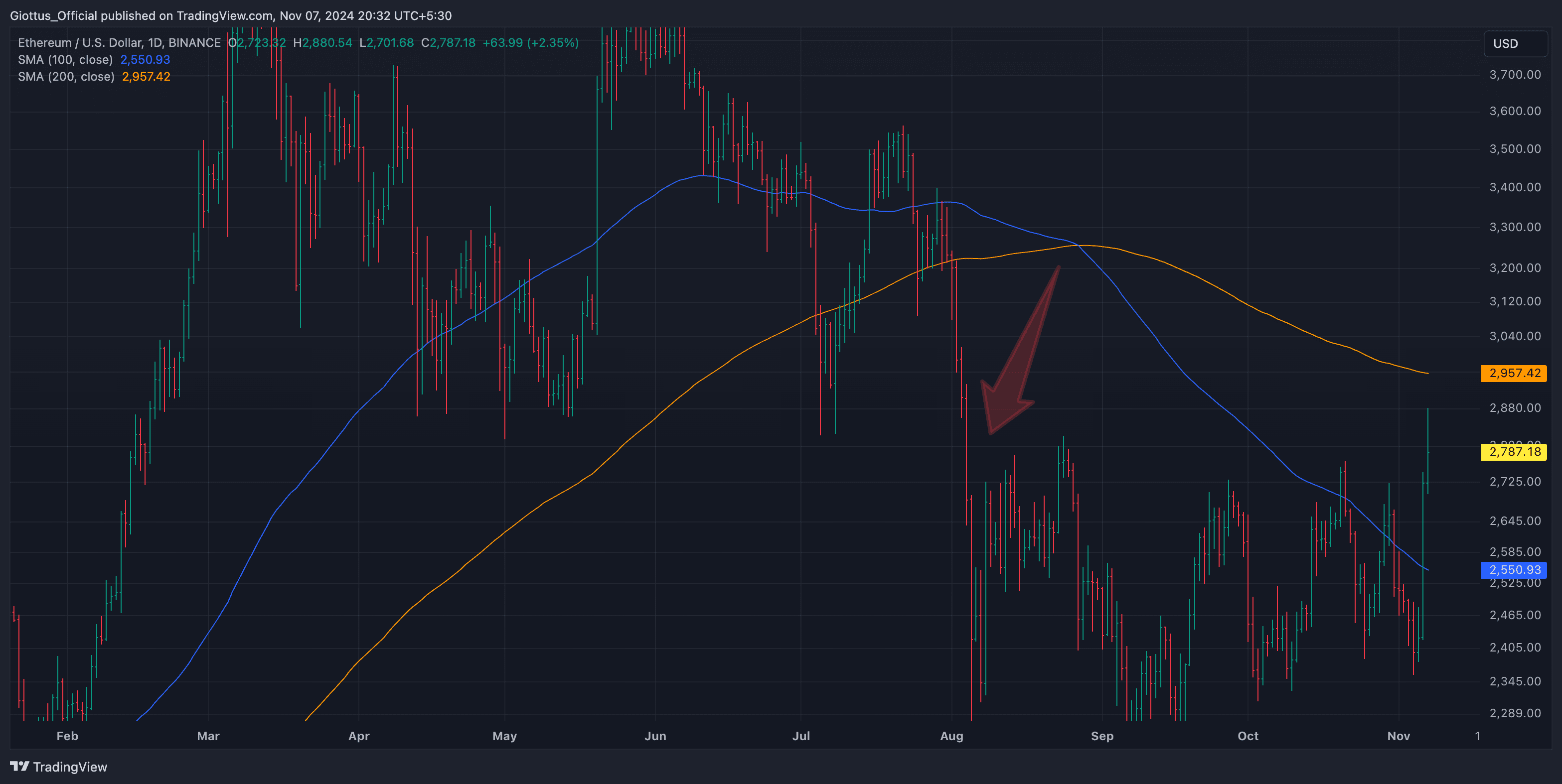

On the daily chart, Ethereum (ETH) is eyeing a key resistance level at $2,957—a price it hasn’t broken since August 2. This recent move comes after bouncing off support at the 100-day moving average.

If ETH can push past the $2,950 level, it could rally up to $3,300. Buyers previously held the $2,800 zone for nearly four months before the August drop, so reclaiming this range now would signal strong bullish momentum.

ETH/USD trading pair. Source: Tradingview

Looking further ahead, a move above $3,300 could put ETH on track to aim for a new all-time high, showing even more strength over the longer term.

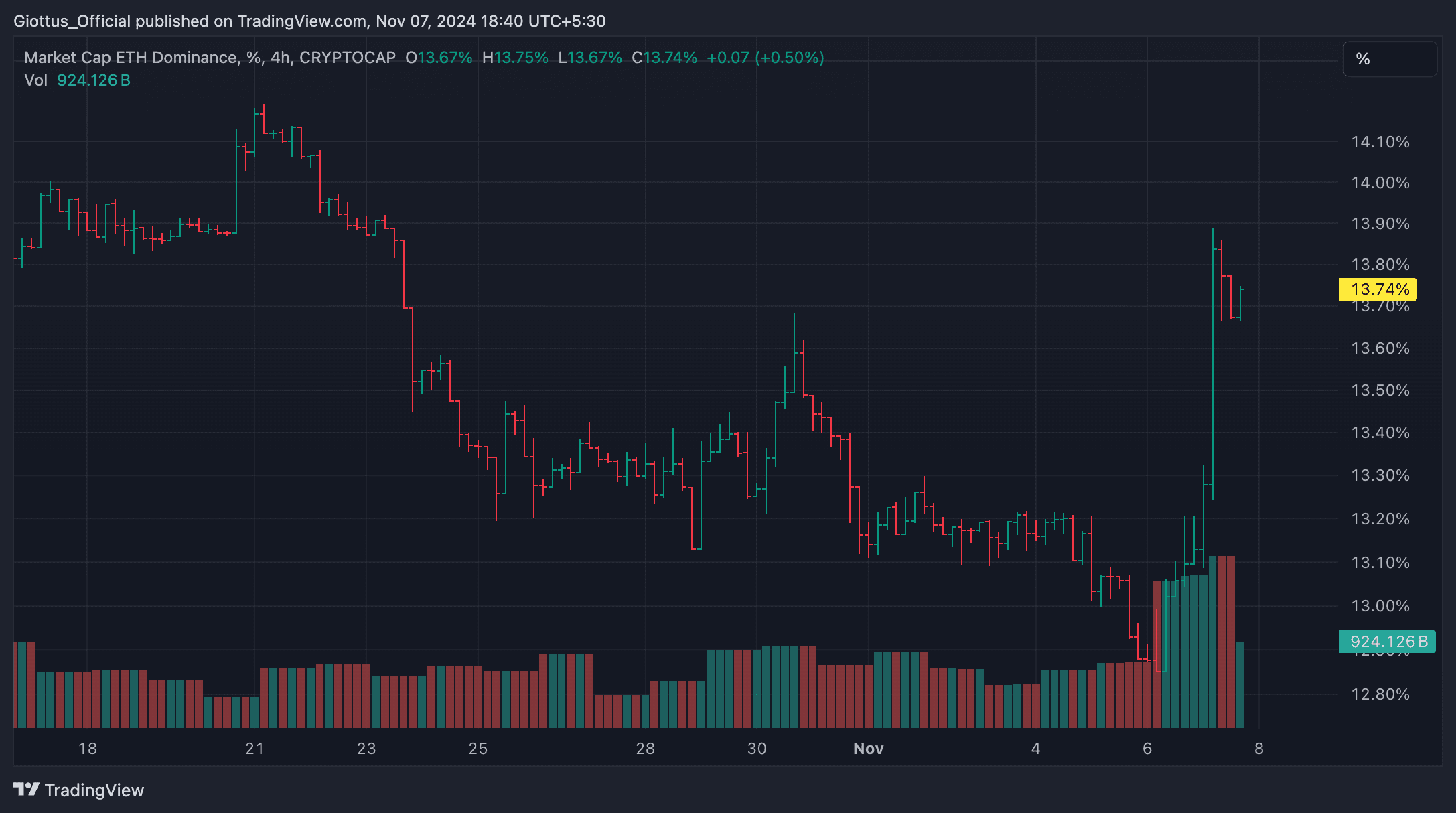

Ethereum dominance surges

Ethereum’s market capitalization dominance has surged recently, signalling renewed interest and confidence in its ecosystem. It currently stands at 13.7%, up from 12.8% just a few days prior. This represents one of the largest single-day jumps in Ethereum’s market share in recent months, fuelled by a combination of price appreciation, increased network activity, and growing demand for Ethereum-based DApps.

ETH dominance. Source: Tradingview

This shift in dominance comes amid Ethereum’s price rise to approximately $2,800, with trading volumes reflecting heightened activity across DeFi, NFTs, and Layer 2 solutions. For context, on-chain data reveals a recent 60% increase in total fees as user engagement picks up, signalling that users are returning to the network.

Right now, both open interest and funding rates are rising, but they haven’t hit any risky highs yet, meaning there’s room for more rallies without immediate concerns of overheating. This increase in these metrics shows a stronger interest and a positive outlook from futures traders, pointing toward a generally bullish sentiment.

Key Takeaway

Ethereum is evolving from being just a platform into a thriving, multi-layered ecosystem. With deflationary tokenomics, a dominant position in DeFi and NFTs, and a rapidly expanding Layer 2 network, ETH stands on solid ground with metrics that support long-term value growth.

As institutions and developers alike continue to build on Ethereum, these unique data points highlight why ETH is well-positioned to lead the market in the next 4-6 months. Do you own any ETH currently? If not, do look at it.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.