Crypto vs Central Bank Digital Currencies: Explained

At the outset of April, 2021, plenty of governments across the world have started considering the possibilities of CBDCs (central bank digital currency) and even testing the currencies out — with China and the USA at the forefront, and India very likely about to enter the game. This central bank digital currency has also been dubbed a ‘national cryptocurrency’, and so naturally, both the crypto enthusiasts and the general populace have been questioning how similar these CBDCs actually are to digital currencies like Bitcoin or Ethereum, and how to buy CBDC is something investors are excitedly enquiring.

In this post, we attempt to answer both those questions.

But first, let’s learn the basics about these CBDCs, shall we?

So, What Exactly is a Central Bank Digital Currency?

A central bank digital currency is a virtual representation of a particular country’s government backed currency, controlled by the central bank; this is why a CBDC is also known as a national cryptocurrency. In 2021, CBDC is pretty much a new currency, mostly untested as only a few countries have tried them out so far.

The design of a central bank digital currency varies from country to country, especially when it comes to factors such as privacy, access, and the underlying architecture of the systems. However, most governments have chosen to use the blockchain tech as the premise for their national cryptocurrencies, so as to simultaneously increase trading efficiency and facilitate cost-effective transactions. This is one of the reasons CBDCs are likened to regular cryptocurrencies, even though the two are vastly different.

Cryptocurrencies vs. CBDCs: When Did the Debate Start?

2009 witnessed the OG crypto Bitcoin’s introduction and subsequent success, and as numerous altcoins have kept being launched over the years since then, the community of devoted crypto traders has only grown in number around the globe. The decentralized and permissionless structure of them has gotten so popular, in fact, that they might be able to replace traditional financial systems controlled by an authority figure (like a central bank) in the very near future.

In the first decade or so since their arrival, governments all over the globe didn’t particularly care about this massive threat cryptocurrencies posed to fiat money. However, as Facebook launched their own cryptocurrency — Libra — in 2019, central banks first recognized that a crypto launched by a company as acclaimed as Facebook could easily draw a large portion of the population away from centralized finance.

This was when the cryptocurrency vs. central bank digital currency debate first made an appearance. Governments from leading nations around the world started trying to exert some control over the rising adoption rates of cryptocurrencies.

Along with that, central banks also began to consider utilizing a similar technology to the blockchain in the existing centralized financial systems. In a matter of months, central banks like the People’s Bank of China (PBoC), the U.S. Federal Reserve Bank of Boston, and European Central Bank (ECB) came up with the notion of a central bank digital currency, or a national cryptocurrency.

So, What Are the Primary Differences Between a Central Bank Digital Currency and a Cryptocurrency?

The very first, and the most glaring distinction between a national cryptocurrency and a regular cryptocurrency is the conflicting objective behind their creations. The mysterious developer of Bitcoin — Satoshi Nakamoto — brought the crypto into existence right after the global financial crisis of 2008, with the sole purpose of allowing users to have full control over their finances and avoid the supervision of a central authority figure/institution. Bitcoin, as well as all other cryptocurrencies, are intended to offer users the chance to escape the control of central banks.

However, as you must have already gathered by now, CBDCs actually bring users back under the control of central banks and governments, which goes against the fundamental nature of cryptocurrencies. So a national currency aims to preserve the dominance of the centralized financial systems, while cryptocurrencies focus on decentralizing finance for the general populace.

While CBDCs are perceived negatively by a large number of people due to the centralization factor, cryptocurrencies also have quite a few disadvantages. Namely, the price volatility associated with all virtual currencies.

While cryptocurrencies are powerful enough to revolutionize the modern financial markets, the ever shifting prices of them is one of the factors that keeps them from going mainstream. However, since CBDCs are reserve-backed and controlled by the central bank, there’s far lesser chances of the prices of national cryptocurrencies being volatile.

Despite the fact that a CBDC is called a national cryptocurrency, and despite the few similarities between a central bank digital currency and a cryptocurrency (such as the digital medium and the underlying blockchain technology), it’s pretty clear that the two aren’t even remotely similar. A central bank digital currency can essentially bring together the best of both centralized and decentralized finance — so while they will have the easily accessible and secure nature of cryptocurrencies, they will also have the regulated, non-volatile money circulation of traditional finance.

Possibilities for a National Cryptocurrency in India

If you’re wondering how to buy CBDC, you can’t do that in India right now, obviously, since India hasn’t got a CBDC yet. However, you’ll be happy to know that a national cryptocurrency in India might become a reality in near future.

Not to be outdone by China, the USA, Europe, or any of the other countries already planning for a CBDC, the Reserve Bank of India (RBI) announced on 25 January, 2021 that it is investigating the prospective for an Indian national cryptocurrency.

The Lok Sabha Bulletin Part II states that The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 is expected by some to be introduced by the Indian Government during the Budget session of the Parliament, and could possibly involve the banning of private cryptocurrencies like Bitcoin or Ethereum in India, much to the dismay of crypto traders in India. While we’re hopeful of a positive turn of events, there’s no denying the appeal of CBDCs in this development.

CBDCs vs Cash

CBDCs are also worthy of comparison to current monetary systems — physical cash and the digital equivalents we use today. There’s sufficient data to suggest that CBDCs would be an ideal fit for today’s increasingly digital society. They may even be a large catalyst in furthering digital adoption and lead to less physical cash being used.

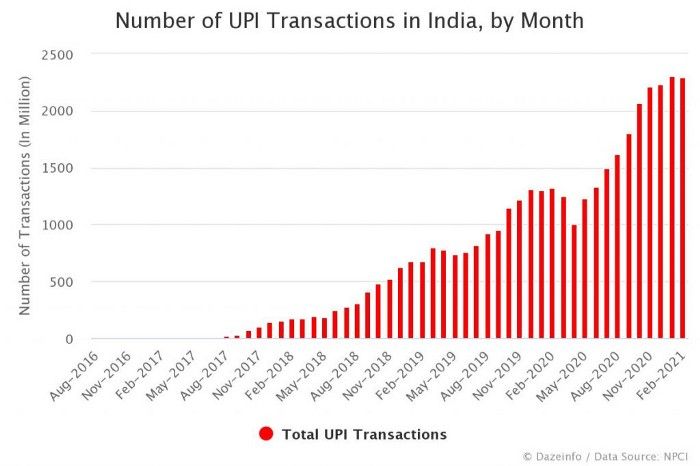

Take India’s numbers. The growth of the United Payments Interface (UPI) adoption in making payments is arguably one of the most pleasing graphs anyone in the financial sector would like to see. In just about 2 years, the number of transactions using UPI rose from about 250 million a month in late 2018 to nearly 2 billion a month.

Clearly, there’s an appetite for digital transactions. And a CBDC may be the ideal tool for the next phase of growth in this arena.

The digital rupee can help the RBI take a step closer to complete financial inclusion, bring about a cashless society, and do away with a lot of the drawbacks of traditional banking. At Giottus, we’re beyond excited to be witnessing the growth of CBDCs, both in India and globally!

Updated on: 26th November, 2025 3:01 PM