With Bitcoin breaking above $73,000 earlier this week, traders and investors alike are left wondering if this rally will sustain or fizzle out post-election. In the options market, implied volatility has surged as investors price in about a 5% potential daily move, reflecting the uncertainty surrounding the election.

While the price momentum has slowed down temporarily, we believe that this is a temporary snag and could catchup once the profit taking exercise ceases and the post-election FOMO kicks in. Today, we decode the drivers that could propel Bitcoin to uncharted territory.

The Trump Effect

The upcoming US presidential election brings a unique twist to crypto. Market participants, noticing Trump’s favourable stance towards crypto, seem to be positioning BTC as a potential hedge.

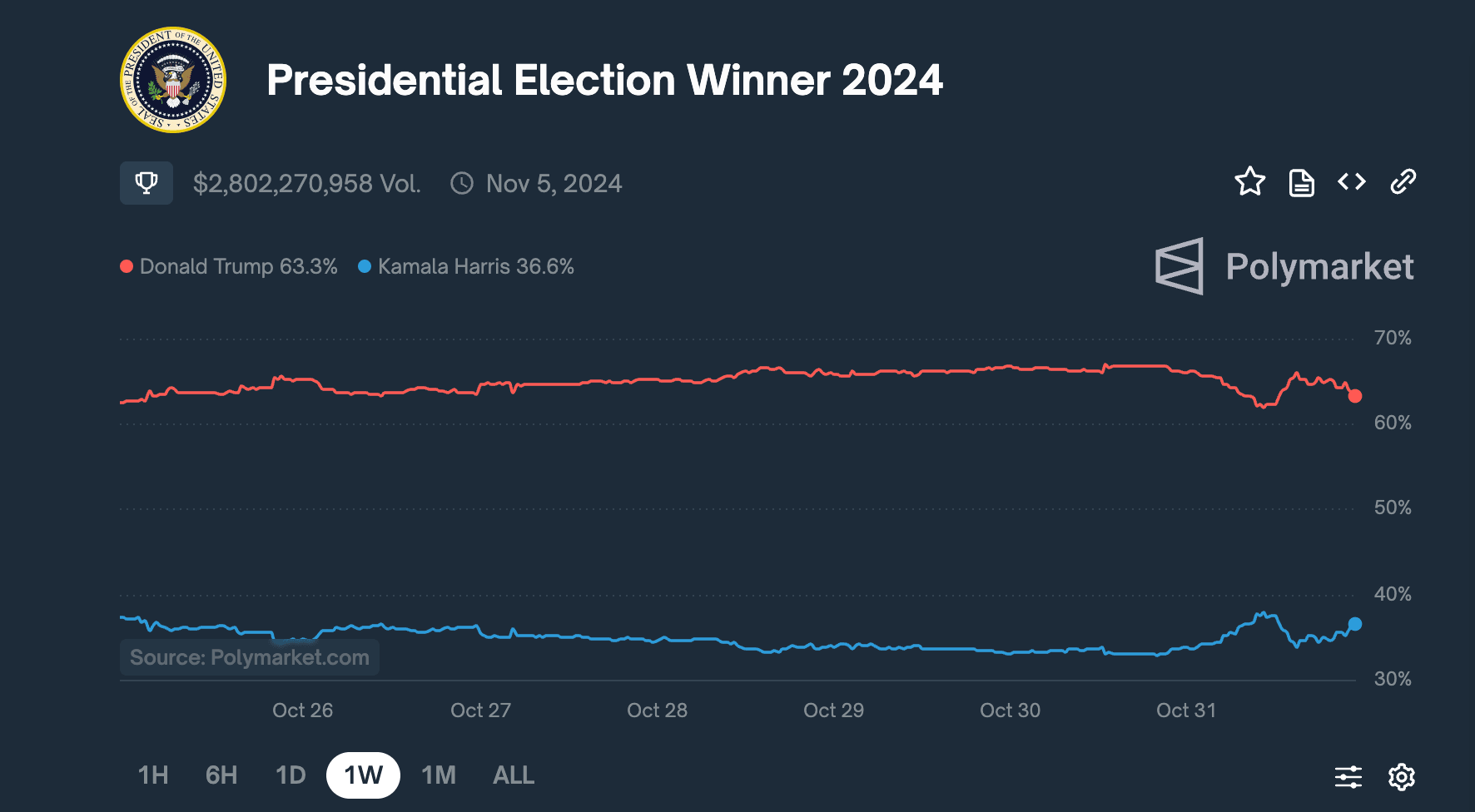

Source: Polymarket

According to Polymarket, Trump’s odds of victory have significantly increased, signalling a strong move in crypto, as BTC aligns with Trump’s pro-crypto policies. As the election looms, crypto markets may see heightened volatility, with BTC potentially benefiting from “Trump-friendly” sentiment.

Institutional Momentum: Microsoft, BlackRock could ramp up their involvement

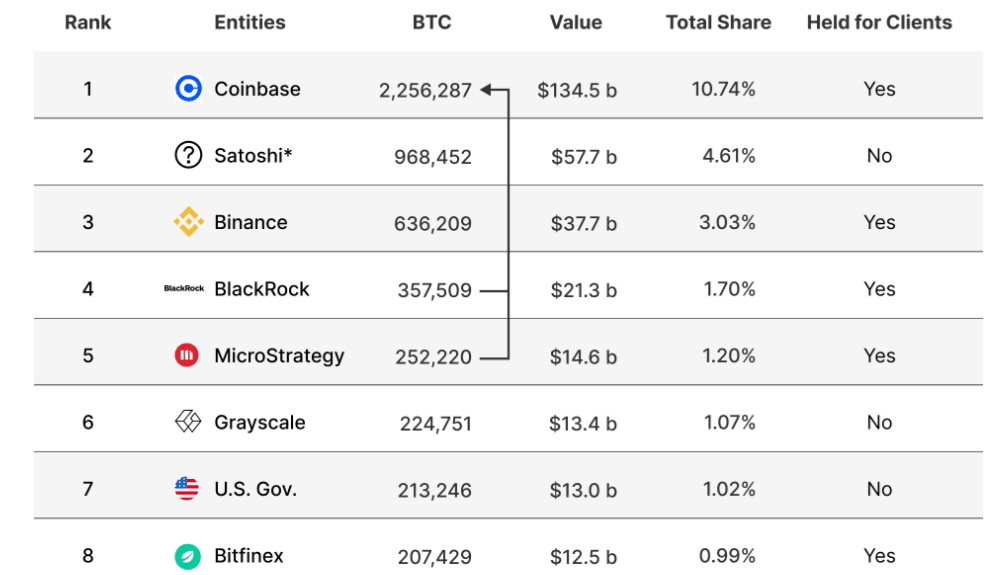

Institutional adoption continues to be a critical driver, with recent developments like Microsoft shareholders voting on Bitcoin investment and BlackRock’s Bitcoin ETF crossing a massive $30 billion in holdings. Major institutional players, like BlackRock and Vanguard, are increasingly involved in Bitcoin, adding significant credibility to its role as a stable store of value and an institutional asset.

Source: River

Institutional inflows may accelerate post-election, assuming a favourable regulatory climate. A Trump win could pave the way for a new wave of capital into BTC, driving an extended rally into 2024.

Potential Microsoft’s Bitcoin Purchase Could Lead to Market Supply Shock

• Microsoft has included an unexpected proposal, "Assessment of Investment in Bitcoin," for a vote at its annual shareholder meeting on December 10, 2024, but the board advises voting against it.

• If approved, Microsoft could potentially invest up to 10% of its $76 billion cash reserves in Bitcoin, translating to around $7.6 billion or about 104,109 BTC.

• A large Bitcoin purchase by Microsoft could create a supply shock in the market, given that over 80% of Bitcoin hasn’t moved in over six months and exchange balances are at a 4-year low.

MicroStrategy plans to raise $42 billion to buy Bitcoin

• MicroStrategy, led by Michael Saylor, has announced a bold “21/21 plan” to raise $42 billion over the next three years to increase its Bitcoin holdings. The funding goal will be split between $21 billion in equity and $21 billion in fixed-income securities.

• One critical aspect to note is that this amount is just shy of MicroStrategy's entire market value of about $45 billion.

• Since beginning its Bitcoin purchases in 2020, MicroStrategy has acquired around 252,000 Bitcoins at an average cost of $39,266 each. By September 30, the company's Bitcoin holdings were valued at $16 billion, accounting for roughly one-third of its total market value.

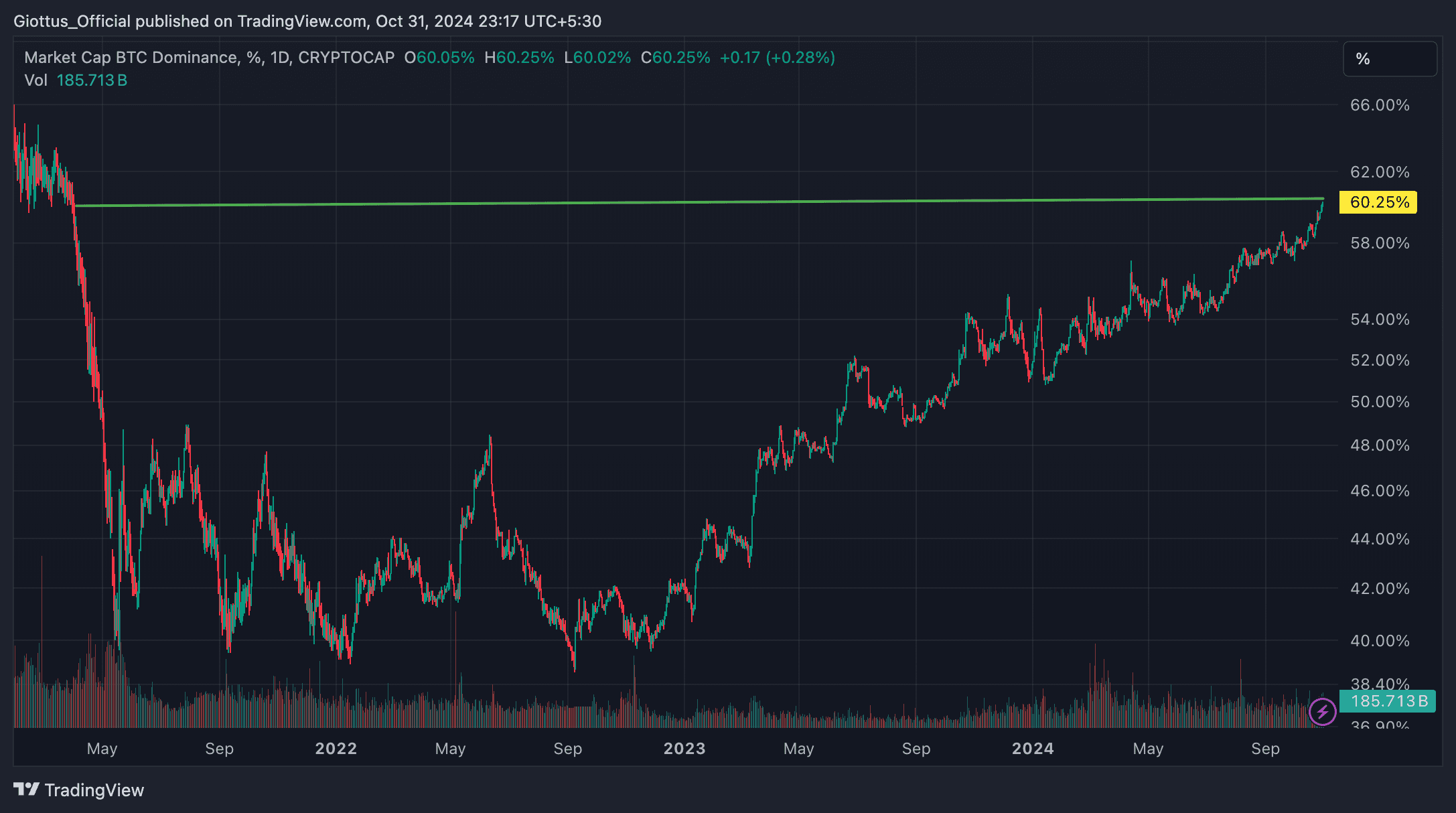

Bitcoin dominance surges beyond 60%

Bitcoin dominance (share of crypto market cap) has been climbing and is currently above 60%, as altcoins have struggled to match Bitcoin’s momentum. This shift points to a growing “Bitcoin black hole effect,” where capital flows into BTC rather than altcoins, consolidating Bitcoin’s role as the market leader.

Global demand for Bitcoin: New highs in Euro, AUD, and CAD

Bitcoin has recently reached all-time highs in currencies like the Euro, Australian Dollar, and Canadian Dollar, highlighting its resilience against local currency devaluation. This trend is notable as Bitcoin's price action increasingly reflects global fiat weakness rather than just US Dollar moves.

The ongoing decline in fiat currency value, especially in regions where monetary policies are more constrained, continues to enhance Bitcoin's appeal as a hedge against inflation and currency instability.

Technical indicators point to an optimistic outlook

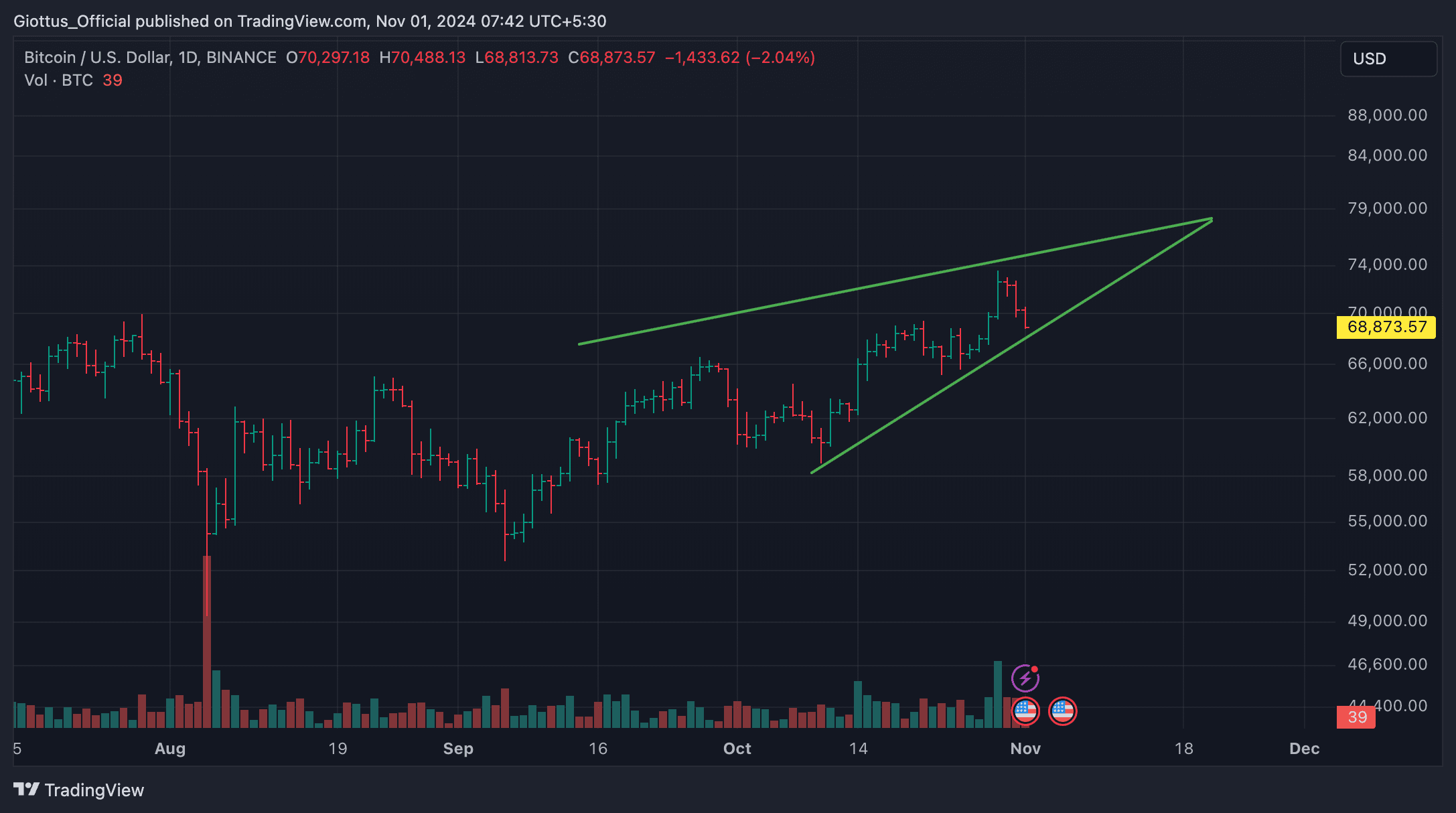

The technical setup for Bitcoin remains highly bullish, with multiple patterns and indicators supporting potential near-term and long-term gains. Key levels and patterns include a bullish pennant formation with targets around $78,800 and a cup-and-handle pattern on the weekly chart suggesting Bitcoin could eventually break past six figures.

Source: Trading View

• Breakout Indicators: Bitcoin’s technicals indicate a breakout is likely underway, with shorter-term targets around $78K, and a potential run to six figures in the next several months if patterns hold.

• Key levels to watch: Analysts are eyeing $84K as a medium-term target and $100K as a major milestone. Bitcoin’s price is closely tied to ETF inflows and macro events, which are expected to add momentum to these price levels.

Key Takeaway

In the short to medium term, Bitcoin appears poised to push into new territory, driven by a combination of election-driven sentiment, heightened institutional interest, and favourable market dynamics. With the possibility of a pro-crypto administration, increased volatility and a potential post-election rally could support Bitcoin’s price surge in November.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.