HBAR, the native token of the Hedera network, exhibited a significant price increase of over 100% this Wednesday. This surge was followed by a correction, with the token's value retracting by 30%.

HBAR/USDT chart. Source: TradingView

Before we get into the details on what led to this price action, lets cover the basics of the network and its native token - HBAR.

What is Hedera?

At its core, Hedera Hashgraph transcends the conventional blockchain framework, positioning itself as the next-gen distributed ledger technology (DLT). Unlike the traditional network, Hedera doesn’t rely on blockchain but operates on a Directed Acyclic Graph (DAG) - enabling higher transaction speeds and efficiency.

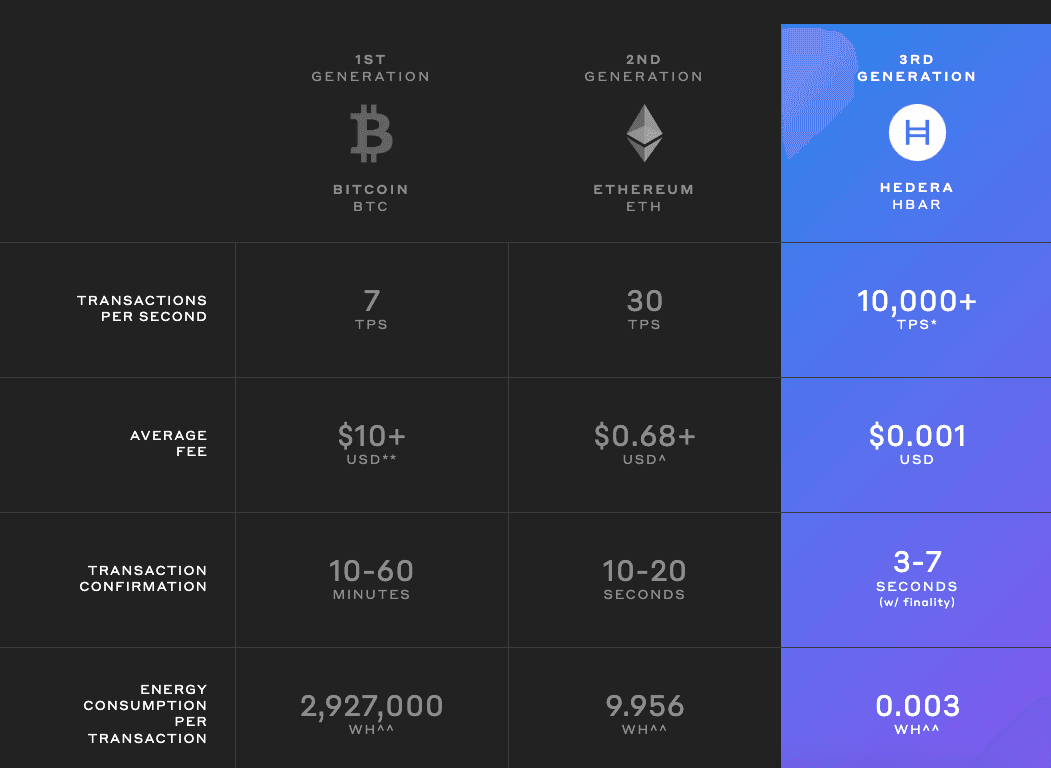

Launched in July 2017 by Dr. Leemon Baird and Mance Harmon, Hedera Hashgraph is well known as the third generation of public ledger, following the Bitcoin and Ethereum. With its proof-of-stake consensus mechanism, Hedera not only facilitates near real-time consensus for decentralized applications (dApps) but also champions a greener, more sustainable future for digital trust.

Hedera Hashgraph works on a consensus algorithm known as hashgraph consensus. It's different from traditional blockchain because it doesn't require proof of work (the process used by Bitcoin and others, which involves solving complex mathematical problems). Instead, transactions are spread across the network using a gossip protocol – basically, one node shares information with another, which then shares it with another, and so on, very rapidly. This enables Hedera to process transactions quickly and in the exact order they were made.

HBAR – the native token

HBAR is the native digital token of the Hedera public network. It serves two primary purposes: it's used for transaction fees and services on the Hedera platform, and it acts as a protective mechanism against malicious actors. HBAR also plays a vital role in the decentralized governance of the Hedera network, as it's used in the voting mechanism for decisions surrounding network updates and pricing.

HBAR comparison. Source: Hedera Foundation

Hedera ecosystem has been busy

From significant strides in enterprise and business domains to bolstering their Web3 ecosystem with DeFi-related integrations and welcoming new members to their governance council, here are some standout highlights of the ecosystem in recent past:

• Notable additions like Hitachi, Mondelez, and BitGo to the Hedera Council

• Collaboration with Algorand for the DeRec Alliance

• New NFT release by AR Rahman

• Joining as the newest DLT member of the Digital Euro Association

• Reaching new all-time highs for Total Value Locked (TVL)

• Seamless integration with the MetaMask wallet

The foundation has bigger goals and plans to use $408 million (4.86 billion HBAR) to expand and improve the network, following a busy year with 33 billion transactions in 2023.

Now, coming back to the HBAR price action this week…

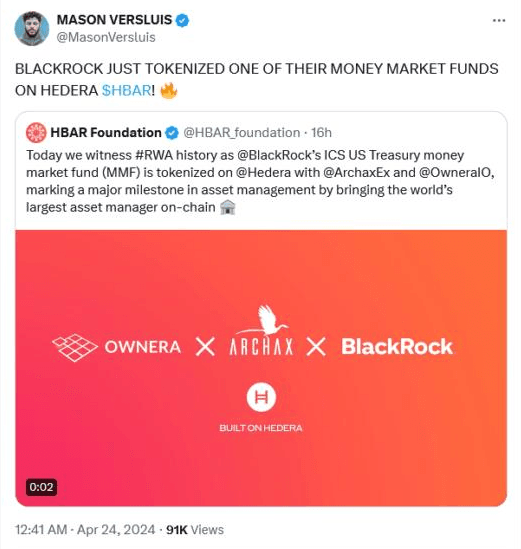

The substantial uptick in HBAR's price was linked to market enthusiasm over a potential association with BlackRock, the world's largest asset manager. This sentiment was fueled by an announcement from the HBAR Foundation, dedicated to fostering growth within the Hedera ecosystem, which indicated that BlackRock’s ICS US Treasury money market fund had been tokenized on the Hedera blockchain through a collaboration with digital securities exchange Archax.

In simpler terms, people started believing that Blackrock is planning to use HBAR and the Hedera Network for their tokenization activity, which led to a classic pumping flywheel.

HBAR Foundation said "BlackRock fund is tokenized”. "Crypto Twitter heard "BlackRock has tokenized fund."

Source: CoinDesk

If you would really like to know more about fund tokenization, we recommend checking out this thread.

Source: X

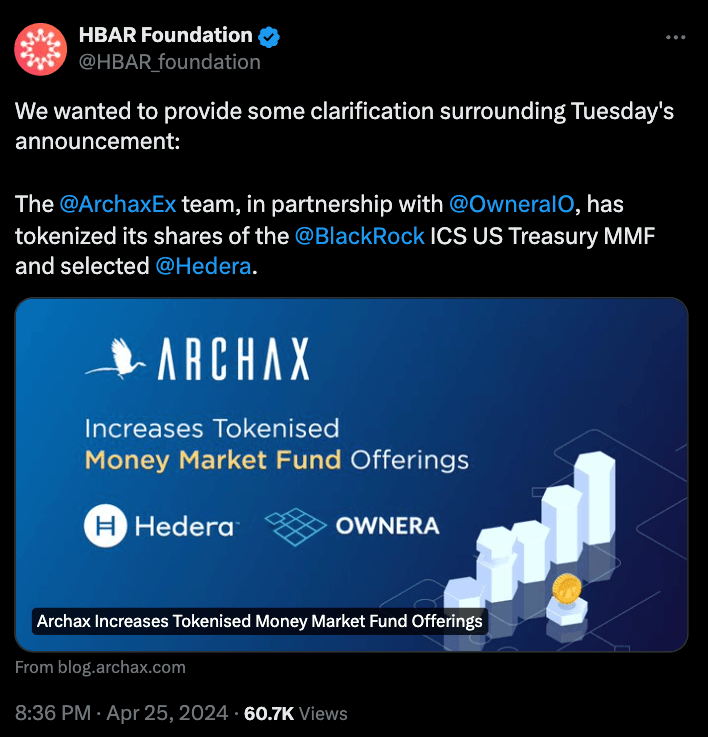

The speculation that BlackRock had explicitly chosen the Hedera blockchain for its tokenization efforts created significant buzz. However, Archax CEO Graham Rodford later stated that the decision to utilize the Hedera blockchain for tokenizing the fund was made by Archax.

Source: X

This response came in the wake of comments that delicately pointed out the possibility of misconstrued marketing messages on the part of HBAR.

Should you buy HBAR today?

This week, HBAR trades peaked at $3.14 billion – a record for the token as more than 60% of the token’s supply changed hands in a trading frenzy. After the initial hype, HBAR retraced to $0.10 from a high of $0.16, potentially extending the slide.

At present, HBAR has recovered and is currently trading at approximately $0.11. Despite the recent fiasco, the token is still up 50% on its weekly while its fundamentals remain intact. Its funding rates have returned to normal. We believe that the way Hedera has set up the ecosystem and the enterprise-centric council is commendable. With a thriving ecosystem, we recommend cost-averaging into HBAR at current levels, as the project shows immense potential and is a viable and solid play for this bull run.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.