Decentralized exchanges (DEXes) have evolved significantly since their early days. The initial versions of DEXes faced challenges such as limited liquidity, basic user interfaces, and a restricted range of assets. Despite these drawbacks, they set the stage for the next wave of more sophisticated platforms. Modern second-generation DEXes have made substantial improvements, incorporating Automated Market Makers (AMMs) for enhanced liquidity and offering more user-friendly interfaces.

Looking ahead, the third generation of DEXes is emerging, aiming to blend the best elements of centralized exchanges with the advantages of decentralization, such as security and transparency.

Today, we look at the key trends emerging in this space and what it can mean for you, the investor.

- Finally, Uniswap has a competitor – Jupiter

Jupiter, a DEX on the Solana blockchain, is making significant strides, challenging Uniswap, the long-standing leader on the Ethereum network. The rivalry intensifies as Jupiter's trading volumes surge, at times outperforming Uniswap's.

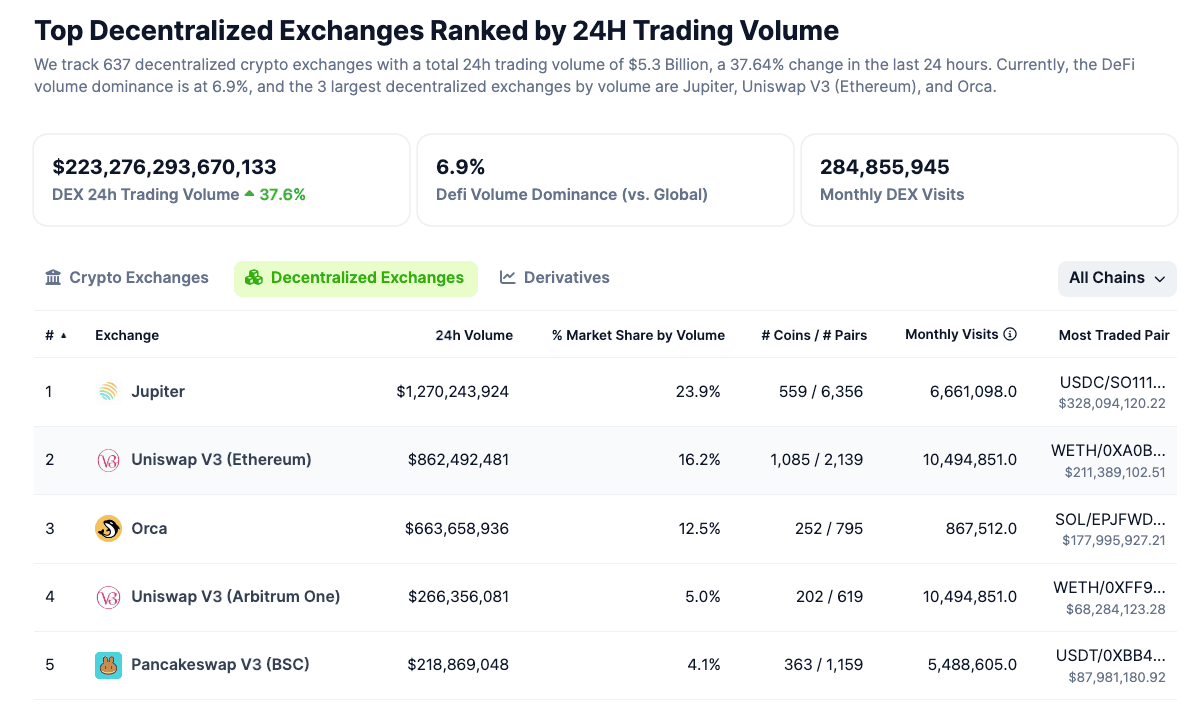

Source: CoinGecko

Recently Jupiter overtook Uniswap as the leading player in the DEX market, accounting for 24% of the total volume share. This dominance is followed by Uniswap V3 with a 16% share and Orca with 12.5%.

Jupiter’s JUP token launched this week and is available to trade in Giottus.

- Ethereum's dominance continues

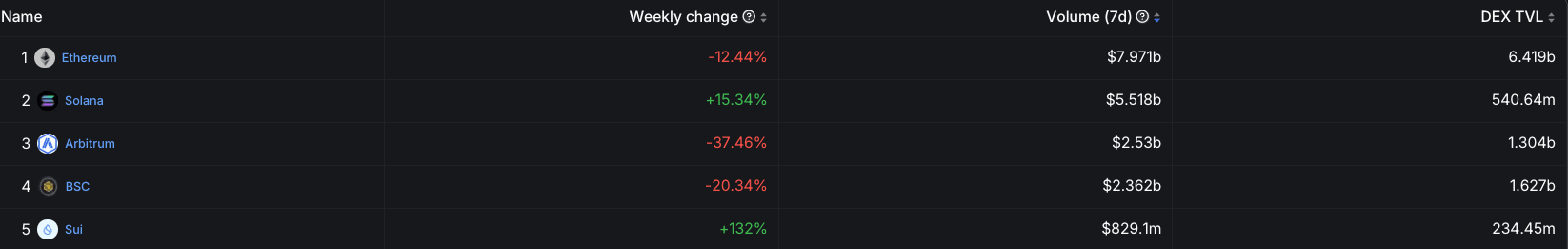

Ethereum has long been the undisputed leader in the decentralized exchanges volume share based on chains, but its dominance is now being challenged by Solana. The recent surge of Jupiter has made Solana switch places with Ethereum’s Uniswap at top of the ladder.

However, in terms of the Total Value Locked (TVL), Ethereum-based DEXes continue to be the reigning leaders on weekly basis with a TVL of $6.41 billion (Ethereum) compared to $0.54 billion (Solana).

Source: https://defillama.com/dexs/chains

- Jupiter’s (JUP) surge to the top

Jupiter has caught the attention of many, processing $1+ billion in volume per day, with an ongoing airdrop initiative to incentivize volume.

Jupiter's airdrop is among the largest in history, with early adopters receiving more than $680 million worth of JUP tokens. The Solana-based decentralized exchange has emerged as the seventh-largest DEX by market cap following the token's launch.

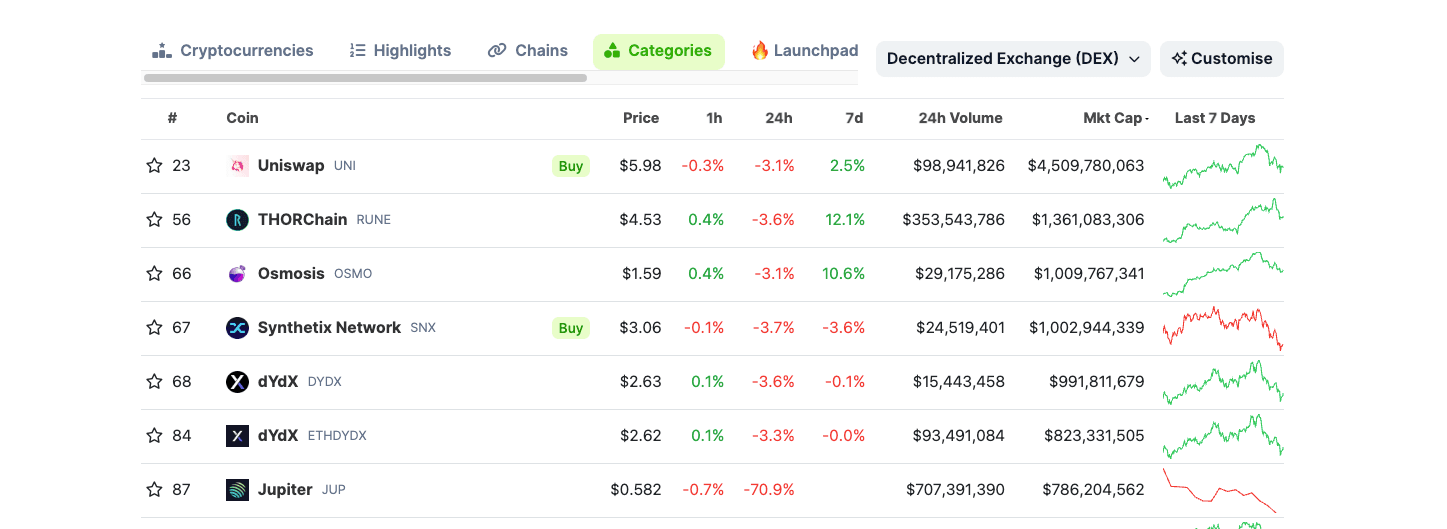

Source: CoinGecko

At $1.3 billion in volume the past 24 hours, Jupiter is the largest aggregator in crypto, according to DeFi Llama

- Tracking key players in the DEX landscape

Apart from the current leaders, Uniswap and Jupiter, there are several leading decentralized protocols that are popular for their niche feature sets.

- Curve (CRV) has made a notable impact with its focus on stablecoin trading, minimal trading fees, and reduced slippage, catering to users across Ethereum, Avalanche, Polygon, and Fantom blockchains.

- Balancer (BAL) stands out with its multifunctional platform that acts as an AMM, DEX, and liquidity platform, popular for its innovative AMM system and flexible "Balancer Pools," which support multiple cryptocurrencies.

- SushiSwap (SUSHI), originating as a fork of Uniswap, has distinguished itself with a unique reward system where liquidity providers earn SUSHI tokens, enhancing its appeal through community governance and incentives.

- GMX (GMX) attracts the attention on Arbitrum and Avalanche for its decentralized spot and perpetual contract trading, offering low swap fees and high leverage.

- Other notable DEXes include QuickSwap (QUICK), AliumSwap (ALM), Injective Protocol (INJ), ZKEX (ZKEX) and Perpetual Protocol (PREP).

- Downside risks of DEXes remain

Trading on decentralized exchanges (DEXes) offers the appeal of autonomy, privacy, and direct peer-to-peer transactions without the need for intermediaries. However, retail investors should approach these platforms with caution, as they come with their own set of risks and challenges.

For instance, DEXes have been targets of various security breaches and hacks, such as the Poly Network hack in August 2021, where hackers exploited a vulnerability to steal over $600 million in cryptocurrency, though most of it was later returned. Similarly, the bZx protocol suffered multiple attacks in 2020, leading to significant losses.

Moreover, customers face vulnerabilities like front-running and impermanent loss, especially when providing liquidity to automated market maker (AMM) pools. These platforms often lack the regulatory oversight and consumer protection mechanisms found in centralized exchanges, leaving users with limited recourse in case of disputes or losses.

DEXes are also not compliant with Indian crypto taxation regime and hence users have the additional burden to own up their transactions and account for them from a tax perspective.

Key takeaways for retail investors

- While the risks associated with DEXes are non-negligible, these platforms also show significant potential for growth. Innovations in blockchain technology, increasing liquidity, and the expanding DeFi ecosystem contribute to their appeal.

- For retail investors interested in the DeFi space, buying and holding the tokens of reputable DEXes could be a strategic investment. These tokens often play a crucial role in the platform's governance and utility, and as the platform grows, there's a potential for the token's value to increase as well.

- However, it's important to conduct thorough research, understand the risks involved, and consider one's risk tolerance before investing in these digital assets.

- If you are interested in Jupiter (JUP), it can be traded in multiple global exchanges as well as in a few Indian ones including Giottus.