The day for Ethereum is finally here. When Ethereum rallies, it leaves everything else behind. A positive market sentiment and speculations of BlackRock’s plans for an Ethereum ETF have given a 10% boost to the asset overnight. Ethereum is now trading above $2,100, a level not seen since May 2022.

Bitcoin had its rub of the green, too, and touched $37,800 overnight before Ethereum surged and took all the shine away. As a result of BTC’s drop to $36,800 subsequently, its dominance fell by 1% to 52.3.

Things are looking rosy at the moment – if a Bitcoin spot ETF approval happens soon, expect a strong uptick in prices in near term.

Today, we are looking at a new project and ecosystem – Celestia. And why it is gaining attention in a short span of time.

Celestia Deep-Dive: Race to provide data availability

Celestia (TIA) is a type of modular blockchain that uses data availability (DA) sampling (making block data more accessible for DeFi developers) and allowing the integration of multiple rollups and Ethereum-based DApps into its ecosystem.

With the race of data availability protocols heating up, Celestia, Avail, and EigenDA have sprung up exogenous to Ethereum which help scale the base layer to levels thought impossible just a few years ago. This week, Near foundation joined the race with the announcement of "NEAR DA", aiming to relieve the Ethereum blockchain of the burden of storing and broadcasting reams of data. The rollout of “NEAR DA” could make posting data on the network 8,000 times cheaper compared to the cost of posting on Ethereum.

Among the data availability solutions, Celestia has a first-mover advantage. Its main net has launched, while EigenDA is yet to launch its test net, and Avail remains in very early stages.

Ethereum also has plans to launch its own Celestia-style solution in the coming years (referred to as Danksharding), although this likely remains multiple years away.

But, what are modular blockchains?

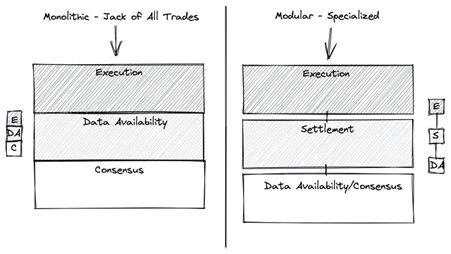

Initially we had monolithic blockchains such as the Bitcoin network and Ethereum that enjoyed top-notch security, decentralization, and high integration. However, their major drawback was scalability due to design limitations making them slower and more expensive.

On the other hand, Modular blockchains break the chain into small layers that can be combined, separating consensus layer from execution to provide enhanced transaction speed and scalability, for example.

Source: Substack

Origins of Celestia

Mustafa Al-Bassam was a PhD student in 2019 at University College London. In May 2019, he proposed a new blockchain concept for sublinear verification of block data availability. The led to the debut of Lazyledger as an Ethereum side chain. In 2021, LazyLedger officially changed its name to Celestia and also released its MVP version of light nodes.

Al-Bassam now serves as CEO of Celestia Labs, the primary developer behind the Celestia project.

For full nodes to generate proofs, they must download and execute all transactions. However when some of the block producers withhold some of the transactions in a block, it creates an issue known as "data withholding attack". While a full node could detect this, as they have the means to check the transaction’s absence, a light node will not be able to do so.

Celestia figured out a solution to this problem through a process called Data Availability Sampling, where they allow light nodes to verify data without needing to download the entire block data. This is done through random sampling of small portion of the block data. After the confidence reaches a certain threshold, the block is made available.

What sets Celestia apart?

• Celestia's modular architecture is one of its key differentiators. It allows developers to create custom runtimes that are optimized for their specific needs, while benefiting from the shared security and scalability of Celestia

• Celestia's data availability sampling mechanism is another key innovation, allowing it to support a large number of transactions without compromising security or decentralization

• In terms of profitability, Celestia offers larger block space compared to Ethereum, making storing data more affordable

TIA tokenomics & use cases

Celestia launched its mainnet on October 31, 2023. TIA is the native token for the blockchain and will have a supply of 1 billion. The token mechanism is designed to inflate at 8% in its first year, which will decrease by 10% each year (7.2% in second year, 6.48% in third year etc.) until it reaches floor of 1.5% annually.

The major use case for the TIA token is to pay for the blob space. In order to use the Celestia network for Data Availability (DA), roll-up developers must submit payforblobs (PFB) transactions to the network for a fee, which is denominated in TIA.

In simpler terms, it is used

1. to pay for data availability services

2. for governance and to establish consensus in the project’s proof-of-stake blockchain

On September 26, Celestia announced their airdrop to 7,579 developers and 576,653 on-chain addresses. 60 million TIA tokens airdropped.

TIA Market Debut

• Celestia’s TIA token debuted on the open market at around $2

• During its first day, TIA/USDT hit $2.5

• The token currently has a circulating market cap of $355 million with $172 million volume (24 hours)

Due to the leanness of the Celestia protocol and its limited functionality as a blockchain, a large part of Celestia’s long-term success will depend on the adoption of the applications and protocols that rely on Celestia as a DA layer.

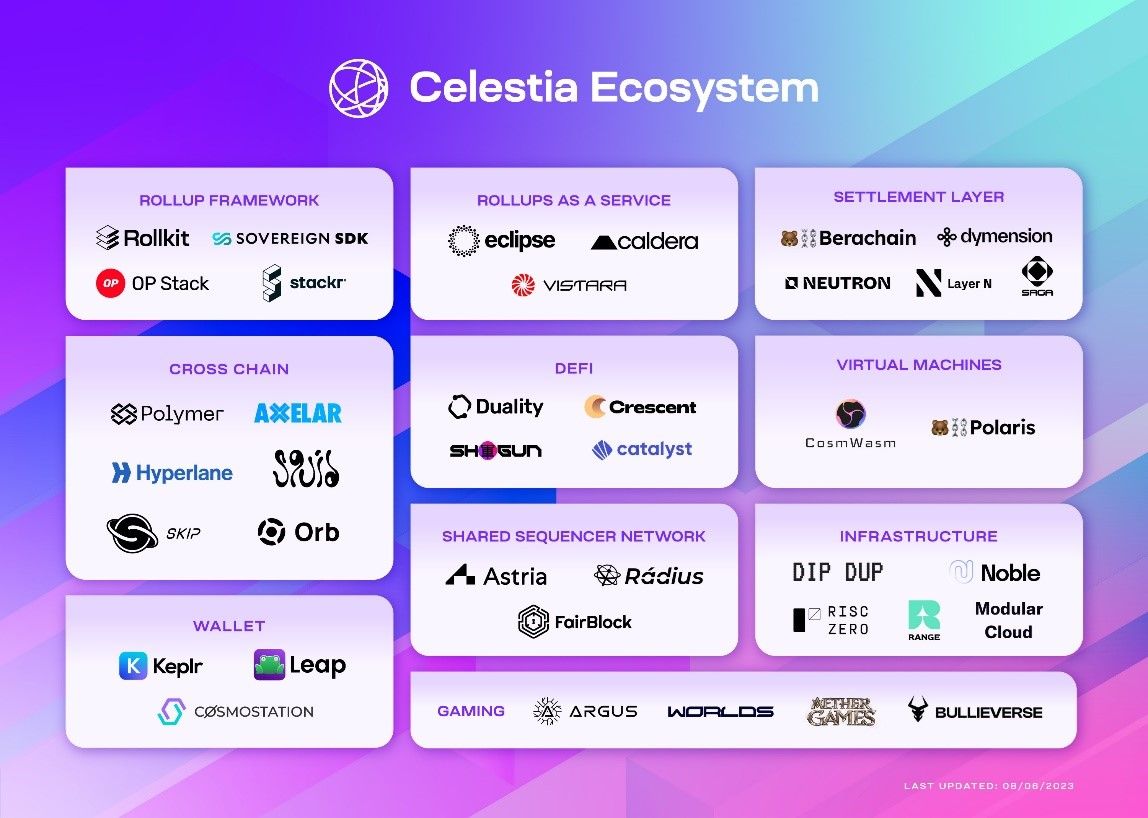

Some of the projects already on the ecosystem are in the image below.

Source: X

TIA: short-term risks

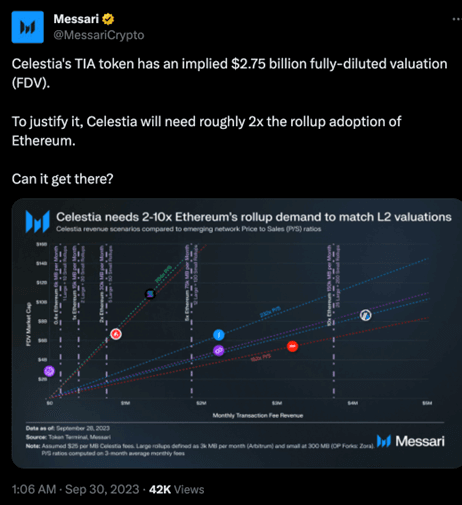

TIA launched with a $2.4 billion fully diluted validation with only 14% of tokens released into the market. Over 50% of the tokens went towards early investors and contributors.

As per market intelligence firm Messari, to justify the valuation, Celestia will need to capture 2x the rollup adoption of Ethereum.

This is ambitious in the short term, given Celestia is yet to capture noteworthy projects using its services. We anticipate a steep correction in TIA market price before it can have a considerable rally in the next two years.

Source: X

Key Takeaway

Celestia and modular rollups continue to improve the performance of Ethereum and achieve effective expansion, which will inevitably affect the competition of L1 public chains in the future. Currently, L1 public chains such as BNB Chain and Celo have chosen to become Ethereum’s L2 Rollups. This is due to the fact that public chains need richer liquidity and costs more to provide services.

Overall, Celestia stands out as a scalable and easy-to-use solution that brings additional scalability to the blockchain landscape. Its modular design, data availability, and cumulative integration make it an attractive option for developers.

There are risks to the project of course – its token TIA seems inflated at the current price and many useful projects still need to be onboarded to make the ecosystem a thriving one.

Not subscribed to Cryptogram yet? Subscribe here

Disclaimer: Crypto-asset or VDA investments are subject to market risks such as volatility and have no guaranteed returns. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.