BLUR is up by 36% this month, among a surge in activity for NFT trading across multiple chains including Ethereum and Solana. While the protocol started out as an NFT marketplace that was loved by the pro traders, the project has evolved beyond NFTs with their layer 2 project Blast L2 and Blend, a lending platform.

BLUR has a monthly unlock event happening since June 2023 that unloads 50 million tokens. Typically, when a massive unlock happens, we see a dip in price movement. However, historical data reveals that in 5 out of the 7 previous unlocks, BLUR’s price had increased, defying the usual market trend.

Blur’s launch was a differentiator

Blur launched a beta version last year to buzzy reception, offering zero trading fees and an airdrop of its native token (BLUR) to traders on the platform. Their key selling point is its targeting of “professional” NFT traders with features like “floor sweeping” across multiple marketplaces, reveal “sniping” and advanced portfolio analytics tools.

Blur listened to the multitude of problems that have plagued NFT traders since day one and designed an innovative marketplace that alleviated all their issues. Firstly, it provided a highly liquid and express trading environment for pro users. Secondly, you can list NFTs for sale on multiple platforms simultaneously.

Blast and Blend add value to its ecosystem

In May 2023, Blur launched Blend (Short for Blur Lending), a peer-to-peer lending platform, that allows collectors to buy blue-chip NFTs with a smaller upfront payment, similar to a down payment on a house.

Growing exclusivity of high-value NFTs has been major issue for aspiring traders. Many see projects they like but lack the funding to obtain the assets. This is where Blend comes in. It provides opportunities to the buy those high-value NFTs.

BLUR also introduced Blast blockchain, an extension of the NFT platform. While the Blast network is yet to have an official launch (slated for this February), they’ve deployed a Multisig wallet where users can pre-fund their Blast account, earn interest on ETH and stablecoins, while earning Blast Points. It has already amassed a considerable $1 billion worth of staked ether (stETH) and $100 million worth of dai (DAI) stablecoin.

Blur has implemented a unique reward system that incentivises user engagement and trading on their platform. These rewards are distributed through airdrops, targeting users who have been actively trading NFTs on the Blur platform. Assets sent to contributors, investors, and advisors will end in June 2027, totalling $1.5 billion at today’s price.

Blur takes pole position among NFT marketplaces

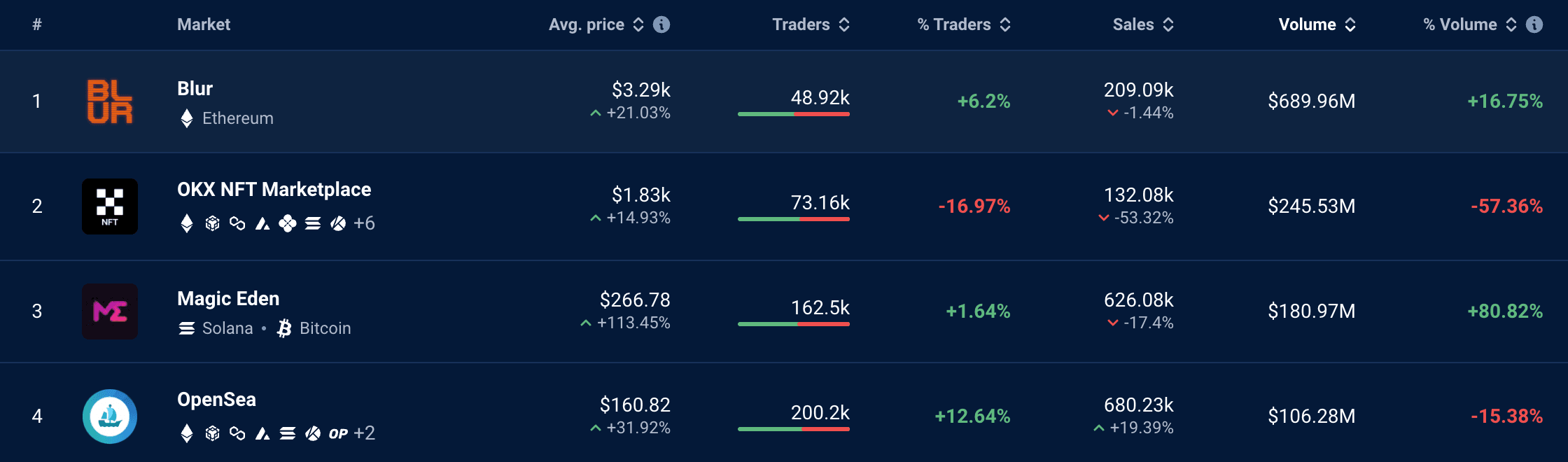

According to DappRadar, in the last month, Blur’s NFT sales volume totalled $690 million, ranking above all other NFT marketplaces. OKX NFT Marketplace and Magic Eden closely trailed behind, achieving sales volumes of $245 million and $180 million, respectively, during the same time period. OpenSea, which was the market leader a year ago, came in fourth place. During the 30-day period considered, Opensea recorded a 15% decline in month-over-month trade.

Source: Dappradar

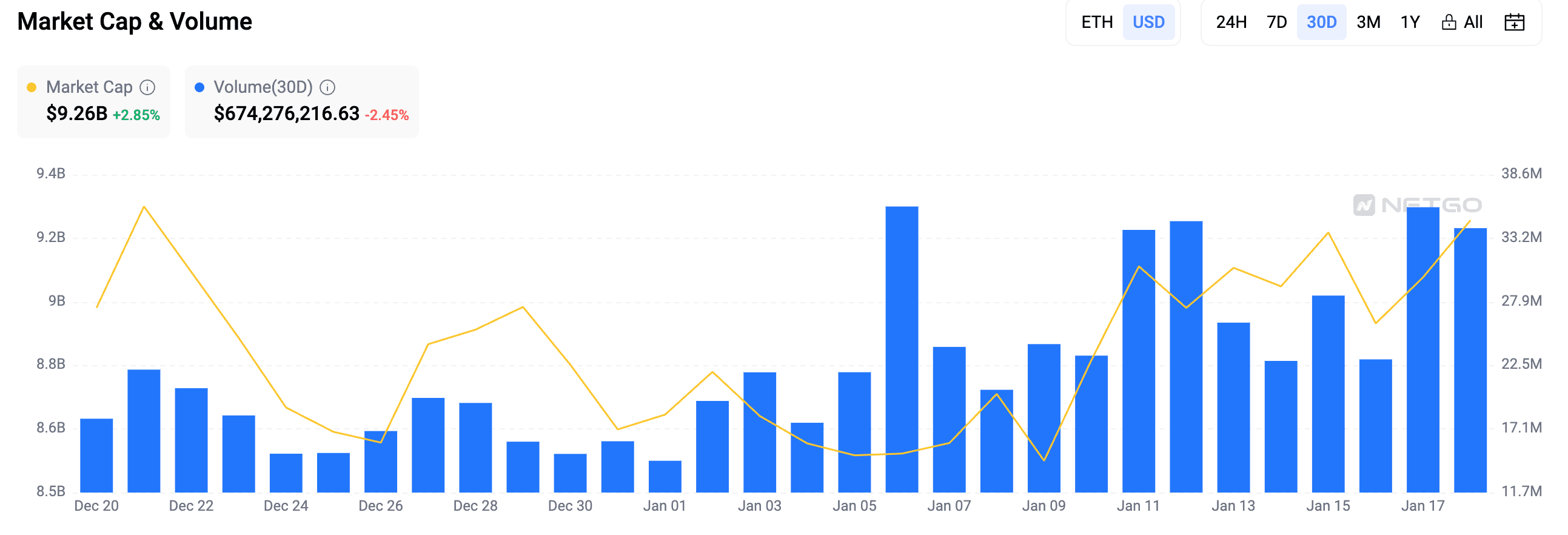

The NFT market, in general, has been experiencing an increase in trading volume, a trend that positively impacts platforms like Blur. The general NFT market capitalisation is $9.2 billion today. Data from NFTGo shows that it has grown by over 3% in the last 30 days.

Source: NFTGo

BLUR TA – should you buy now?

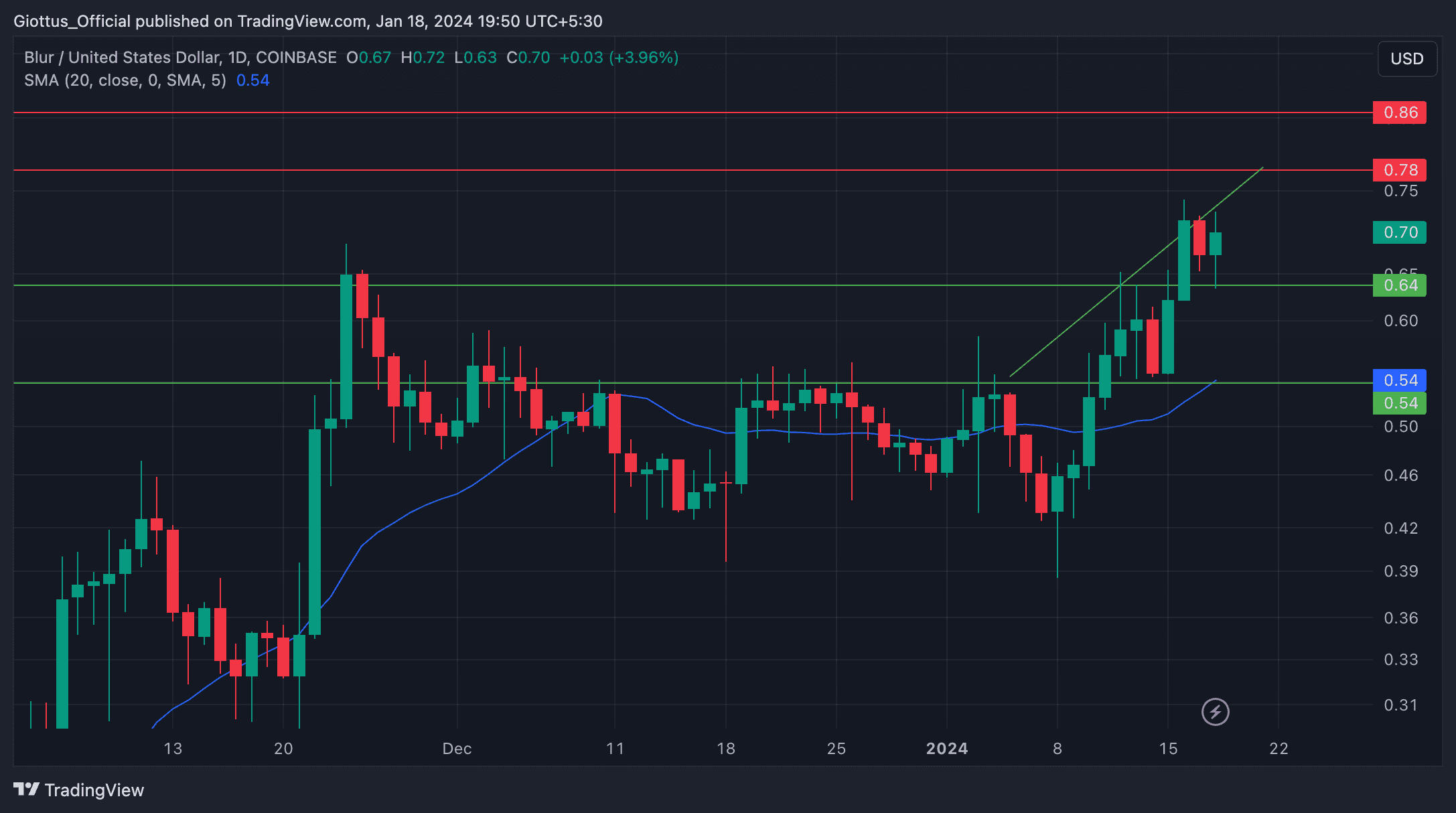

After trading in a close range between $0.41 and $0.52 for weeks, BLUR managed to breakout its psychological resistance of $0.60 earlier this week and is consolidating between the $0.64 and $0.72 range currently.

Source: TradingView

If the asset manages to gain momentum in near term fuelled by aggravated trading volume in NFT markets, it could test its upper resistance level of $0.78, followed by a test of $0.86.

BLUR manages to sustain healthy gains despite token unlocks every month, which goes to prove their resilience. While the recent spike might be attributed towards the impending airdrop for the ecosystem contributors of BLAST, we anticipate the price to rally in the short-term followed by a dip. However, the protocol has immense potential in the long term and can be an attractive buy at $0.50 - $0.60 levels.

Not subscribed to Cryptogram yet? Subscribe here

Disclaimer: Crypto-asset or VDA investments are subject to market risks such as volatility and have no guaranteed returns. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.